The data analysis platform Messari’s Friend Tech report touches on many striking points. The leading platform in the SocialFi sector, Friend Tech, is one step ahead of traditional platforms like Twitter and Twitch with its revenue model. However, there are two major challenges ahead of the platform, and the airdrop conditions that users eagerly await on top of these challenges cause concern. So, what do the data tell us? Let’s examine together.

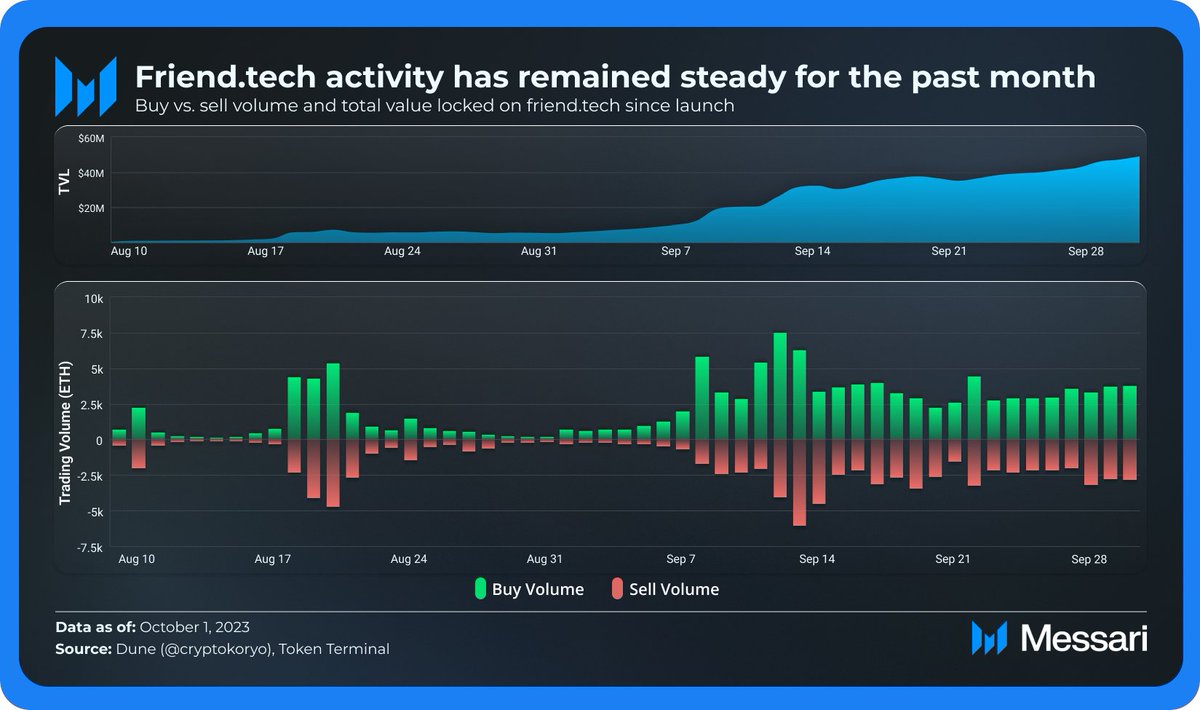

TVL Keeps Breaking Records

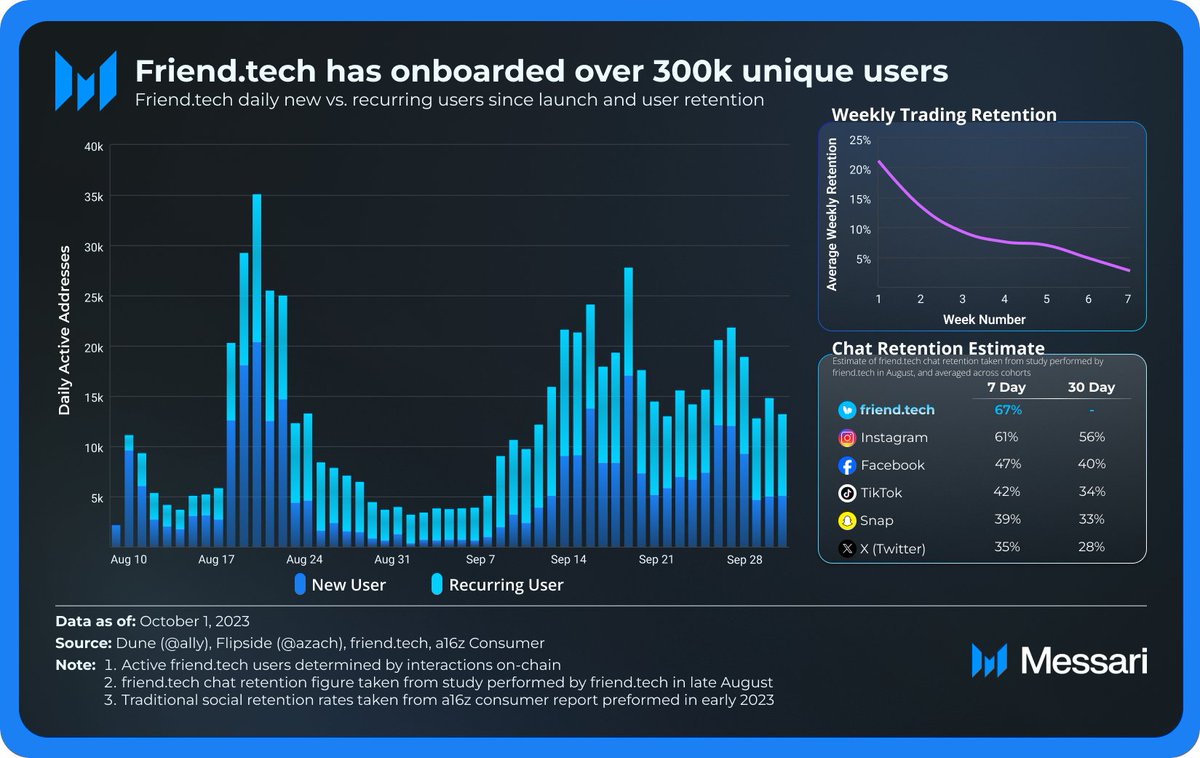

Friend Tech, the pioneer of the SocialFi hype, has attracted the attention of over 300,000 users since its launch. Although user data was leaked due to a code vulnerability in the early days, the team quickly intervened and solved the problem. In recent days, while user activity repeats between 6,000 and 9,000 on average, the weekly average of asset holdings has decreased from 22% to 5%. There are two factors causing this situation; SocialFi platforms offered in different ecosystems and the transaction fees that Friend Tech users have to pay to use the platform.

However, despite these challenges, Friend Tech’s commercial activities gained significant stability in September and the platform’s total locked value (TVL) reached $50 million, setting a new record. According to these data, the platform is continuing its growth in a healthy manner.

Friend Tech earns $320,000 in daily revenue from commission fees, which is six times the current commission earnings of OpenSea. In addition, the increase in daily Revenue / TVL ratio since the launch of Friend Tech has surpassed DeFi giants such as Lido, Maker, and Aave by a factor of over 100.

The Future of Friend Tech

The Revenue / TVL ratio demonstrates both the implementation of an optimized business model and acts as a predictive indicator of a platform’s ability to generate sustainable revenue. So, is Friend Tech’s revenue model sustainable in the long run? Friend Tech’s revenue structure is based on a 10% transaction fee, and half of this revenue goes to content creators on the platform. Content creators who have been producing content since the launch have earned a total of 11,000 ETH from users who purchased keys. This amount is approximately equivalent to $18 million.

Payments per user vary significantly, ranging from a minimum of 0.04 ETH to approximately 250 ETH. Unlike traditional platforms where content pricing is guess-based, Friend Tech offers a revenue model focused on market dynamics. This creates a fairer environment. In addition to all of these, especially for Web3 users, the biggest expectations for Friend Tech are undoubtedly the airdrop activity. The team’s approach to this issue raises concerns among users. The biggest reason for these concerns is the question of how a scoring system will be addressed.

While the current number of users and the numerical data of the platform provide important clues for the future, maintaining this momentum is crucial for the platform’s future. Currently, the platform faces two major challenges: to remain permanent in the SocialFi sector and to attract popular influencers to the platform. These two issues are essential for the revenue stability of the platform.

Türkçe

Türkçe Español

Español