Hong Kong-based cryptocurrency exchange Gate.HK announced it will cease operations on June 1 due to its inability to meet new local licensing requirements. The Hong Kong Securities and Futures Commission (HKSFC) mandated that all crypto exchanges operating in the region must obtain an operational license. Exchanges that do not comply must terminate their services by May 31.

Exchange’s Efforts Failed

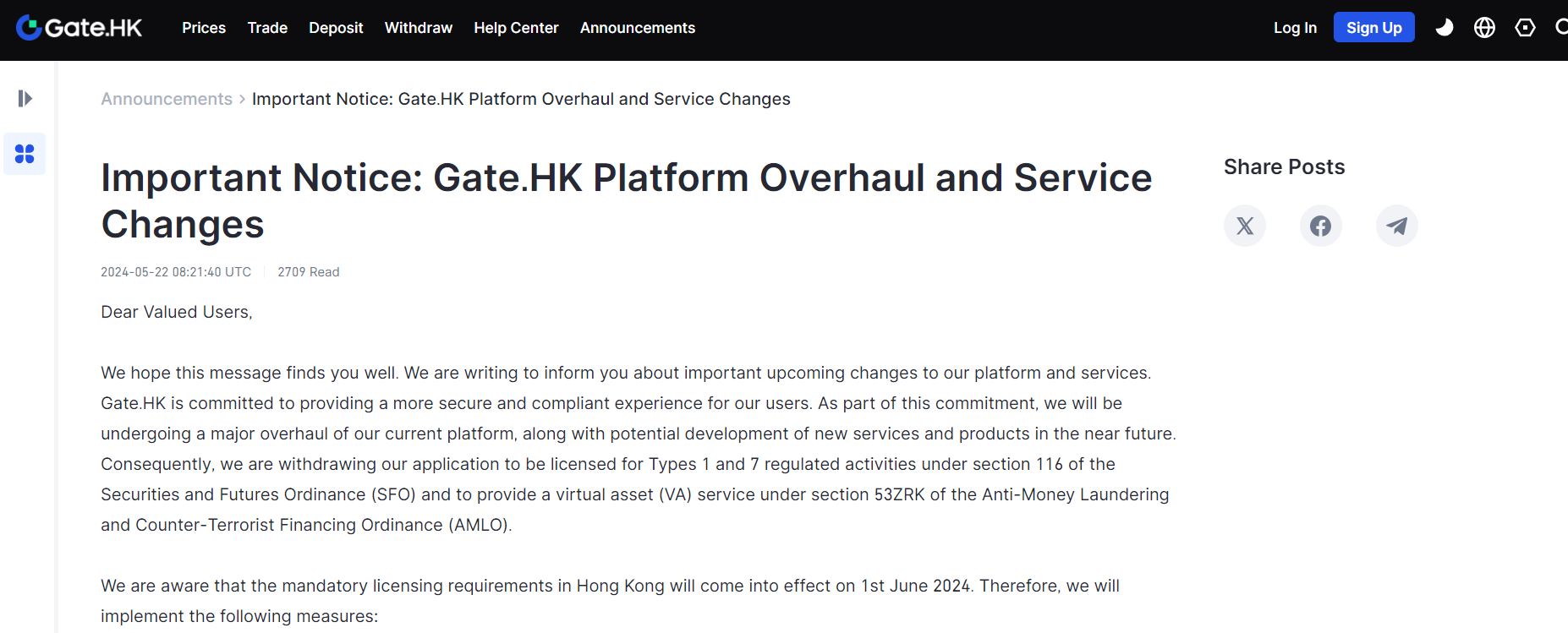

Gate.HK applied for a license with the HKSFC on February 28 to meet these new regulatory standards. However, the exchange withdrew its application on May 22, citing the need for significant changes to its trading platform to comply with strict regulations. Following this development, Gate.HK halted new user acquisition and marketing activities as of May 23.

Existing users can no longer deposit funds and can only withdraw funds until August 28. The exchange plans to fully shut down its trading platform on May 28 and delist all tokens, including Bitcoin, Ethereum, Solana, Polygon, and Tether.

Three More Exchanges Withdrew Applications

Gate.HK‘s closure is not an isolated incident. In May, three other exchanges—Huobi HK, QuanXLab, and IBTCEX—also withdrew their license applications, bringing the total number of exchanges withdrawing applications in Hong Kong to nine. However, twenty cryptocurrency exchanges are still actively applying for Hong Kong’s crypto license.

Gate.HK plans to relaunch its services after a comprehensive overhaul to meet Hong Kong’s regulatory requirements. These requirements include implementing robust Anti-Money Laundering (AML) and counter-terrorism financing measures. The company is committed to resuming operations in the future, aiming to contribute positively to the crypto asset ecosystem once the necessary licenses are obtained.

ETH Staking Move May Come Soon

The HKSFC is exploring the potential for further regulatory developments. A recent Bloomberg report suggested that the HKSFC is considering allowing spot Ethereum ETF issuers to include an ETH staking option. This option would enable issuers to earn passive income, enhancing the appeal of these financial products. The SFC is reportedly in discussions with the country’s crypto ETF issuers about providing staking services through licensed platforms. While these discussions are ongoing, there is no set timeline for implementation.

The evolving regulatory environment in Hong Kong reflects a global trend toward increased regulation of the cryptocurrency sector. As governments and regulatory bodies intensify efforts to protect investors and ensure the integrity of financial markets, exchanges must develop compliance frameworks to adapt to this new environment.

Türkçe

Türkçe Español

Español