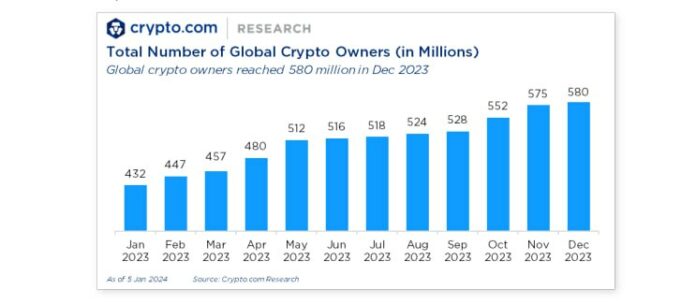

The question of how many people use cryptocurrency worldwide is of great interest to both industry insiders and outsiders. A recent market sizing report published by the cryptocurrency exchange Crypto.com reveals a significant increase in the number of cryptocurrency owners globally. In 2023, cryptocurrency ownership experienced a notable growth of 34%, rising from 432 million at the beginning of the year to 580 million by December.

Analyses from Crypto.com’s Market Sizing Report

Crypto.com adopted a different approach to estimate the number of global cryptocurrency owners by combining on-chain data with various criteria for market sizing estimates. This innovative methodology allowed for a nuanced understanding of the evolving landscape of cryptocurrency adoption.

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Interestingly, the increase in cryptocurrency owners occurred against the backdrop of macro challenges, including the lasting effects of the pandemic and monetary tightening measures implemented by Western central banks to manage inflation and geopolitical tensions in Europe and the Middle East.

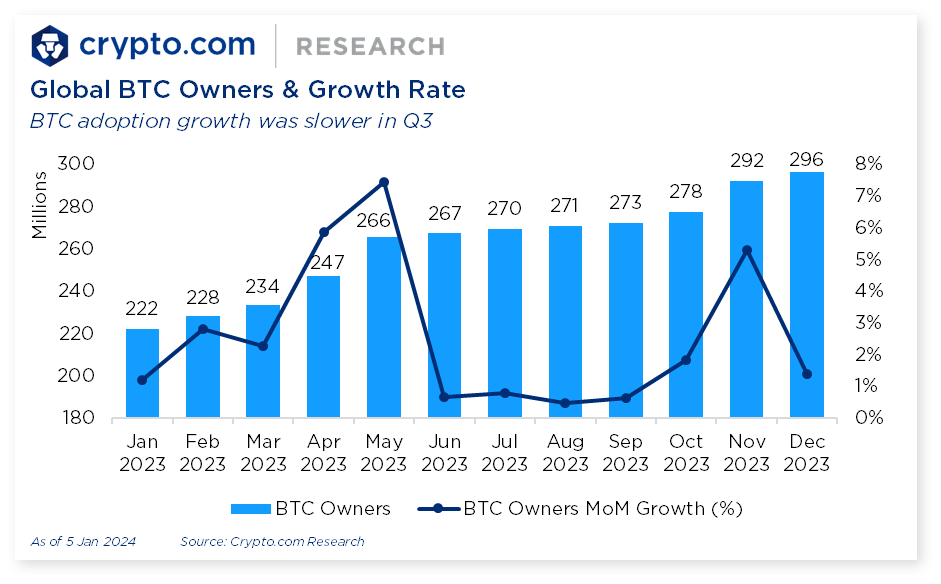

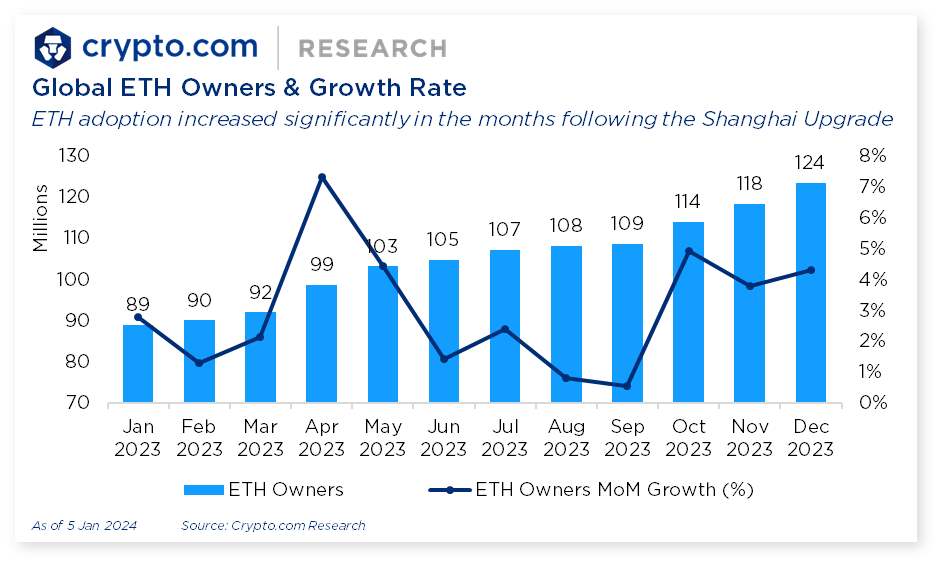

The report highlights the fundamental trends in cryptocurrency ownership, noting that Ethereum (ETH) ownership rose from 89 million to 124 million, and Bitcoin ownership increased from 222 million to 296 million by the end of the year. These figures underline the expanding user base and the growing interest in leading cryptocurrencies.

Driving Factors Behind Bitcoin’s Adoption Increase

As the report indicates, the increase in Bitcoin adoption is attributed to the excitement generated by the launch of Bitcoin exchange-traded funds (ETFs) and the introduction of the Bitcoin Ordinals protocol. The keen interest of institutional investors, especially major players like BlackRock and Fidelity, played a significant role in the prominence of Bitcoin ETFs.

Bitcoin ordinals emerged as a notable innovation in 2023, enabling the creation of NFTs on the Bitcoin network. The report states that there are over 54 million Ordinals on the Bitcoin network, with total inscription fees exceeding 5,473 BTC, equivalent to 257 million dollars. On the other hand, Ethereum’s growth is linked to the impact of liquid staking following Ethereum’s Shanghai Upgrade.

Market Dynamics and Q4 2023 Performance

The report includes data from 23 cryptocurrency exchanges and reveals that 42% of cryptocurrency users do not hold any Bitcoin (BTC) or Ethereum (ETH) in their portfolios. Additionally, Q4 2023 was a strong period for both BTC and ETH, with prices reaching $44,000 and $2,400 respectively. The increase in investor assets awaiting Bitcoin and Ethereum ETFs contributed to this price rise.

Crypto.com CEO Kris Marszalek expressed optimism despite the challenges faced by the crypto sector, stating, “The past year was another significant foundational year for the entire crypto community. Once again, despite headwinds and challenges, the industry proved its resilience and is well-positioned for mass adoption.”

Türkçe

Türkçe Español

Español