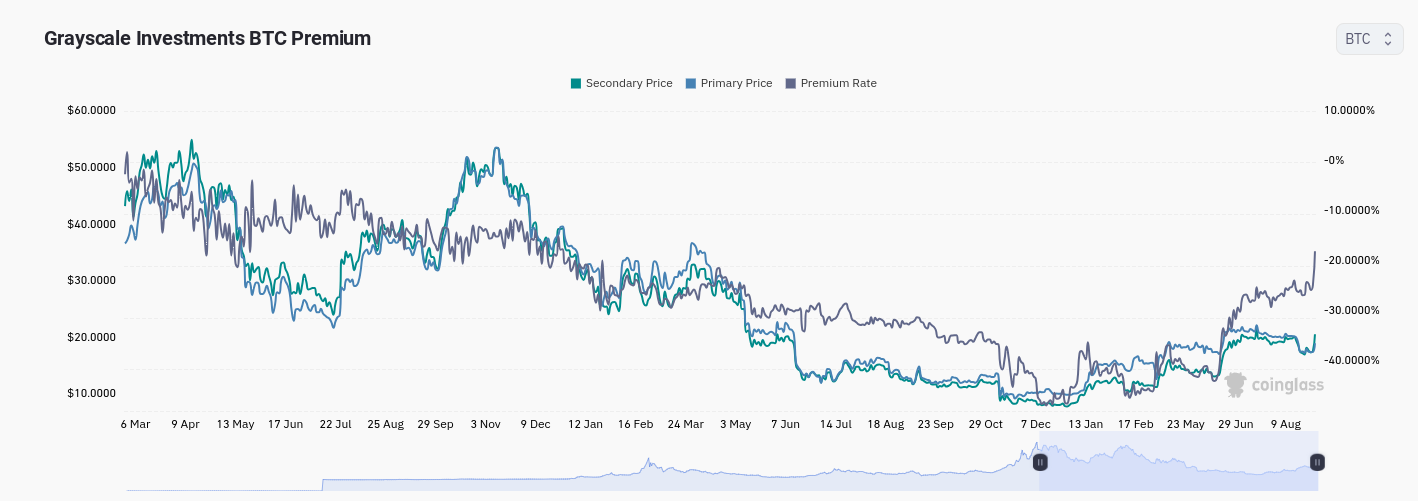

Bitcoin investment vehicle Grayscale Bitcoin Trust (GBTC) may end the “discount” in BTC price by 2024, according to CoinGlass, a monitoring source. In a recent post on August 30, CoinGlass predicted that the GBTC premium will soon return. Additionally, the price movement of Bitcoin indicates a potential reversal sign from some important moving averages (MA), suggesting that Bitcoin’s future performance is worth monitoring.

The Discount of GBTC Will End Next Year

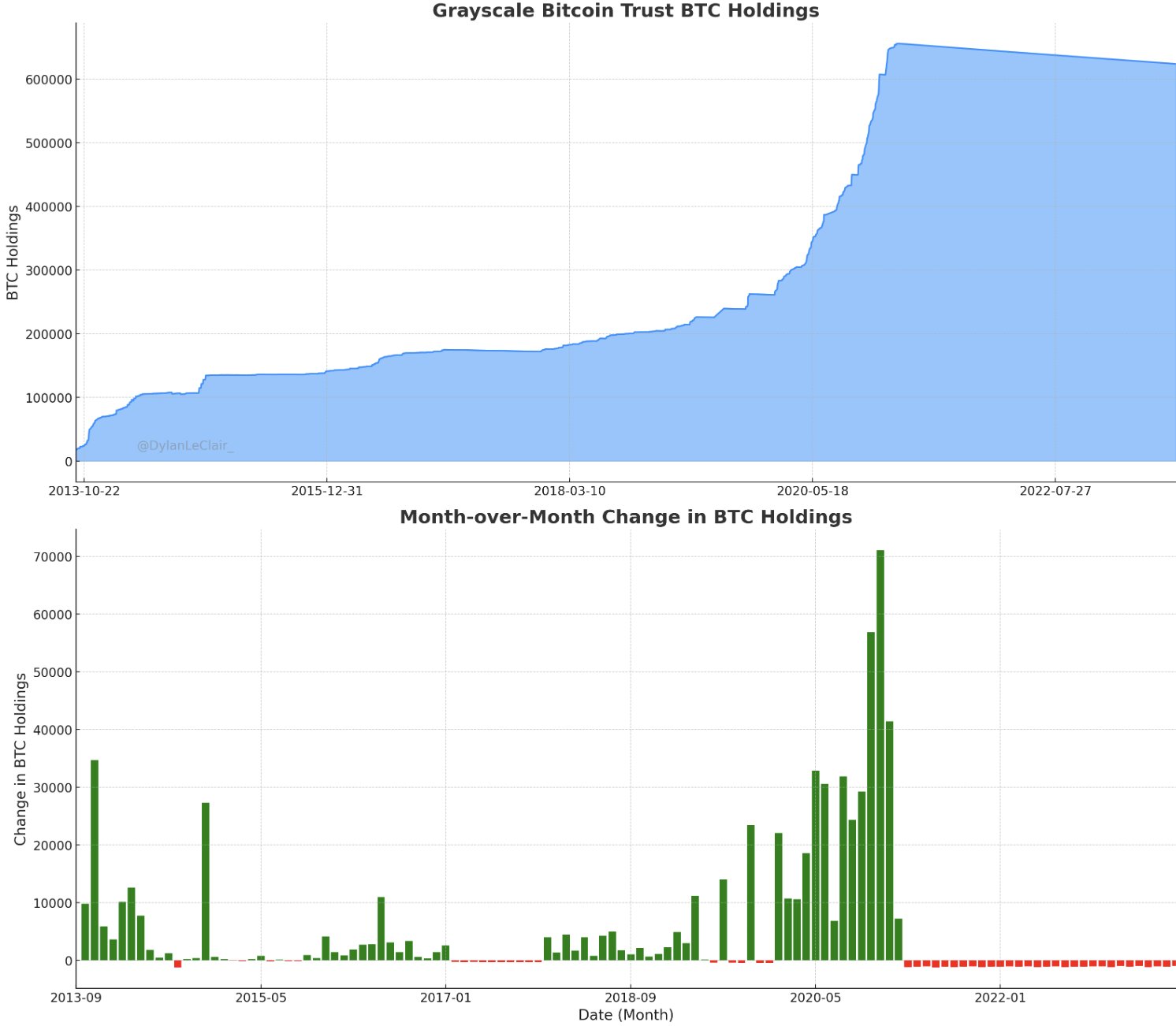

Grayscale’s victory in court against US regulators on August 29 immediately remedied the decline in GBTC performance. The fund holds over 600,000 BTC and has been trading at a lower price than the Bitcoin spot price, also known as the net asset value, since February 2021. This value, once called the GBTC premium, has been negative for over two and a half years, but this situation may change soon.

News that the US Securities and Exchange Commission should evaluate the conversion of GBTC into a Bitcoin spot-priced exchange-traded fund on the same terms as other applicants sent the price of this asset to its lowest levels since December 2021. CoinGlass included the following statement in a part of their comment about the asset:

“Expect Grayscale’s GBTC premium to end the discount next year.”

The Importance of GBTC in Bitcoin’s Bull Run

Dylan LeClair, senior analyst at UTXO Management, evaluated the impact of GBTC on Bitcoin reaching its all-time high, highlighting the size of the assets under management.

“Remember how big GBTC is. They hold over 600,000 Bitcoins and have been the biggest driving force behind the asset value of the 2021 bull run.”

Meanwhile, market participants analyzing the impact of Grayscale news on BTC price movement pointed out the potential reversal of some important moving averages (MA).

Among them, the 200-week and 200-day trend lines, which failed to act as support during the dip to multi-month lows in early August, are prominent. However, data from TradingView showed that BTC/USD struggled to hold both levels, despite closing above them in the previous daily candle.

Popular investor and analyst Rekt Capital reiterated that several MAs continue to be important recovery targets for bulls. In a recent post, they referred to the potential invalidation of the double top structure of Bitcoin on the weekly timeframe.

“This is a great initial momentum coming from the double top structure that has never been fully confirmed and originates from the $26,000 support.”