Cryptocurrency analyst and trader Kevin Svenson provided an analysis that gives investors hope by claiming that two significant catalysts could potentially trigger a bull market for Bitcoin (BTC). The analyst expects the crypto king to make a big move soon.

Analyst Says Bitcoin Moves Parallel to Past Cycles

Svenson, speaking to his YouTube subscribers, stated that the stock market and global money supply are giving positive signals for Bitcoin’s future. The analyst emphasized that the S&P 500 stock index has performed beyond expectations, saying, “The S&P 500 exceeded all expectations. Remember, a few weeks ago, it seemed like the end of the world… But now the S&P 500 is just one percent away from its all-time high. It has returned to the peaks with a perfect recovery.”

Svenson also noted that the global money supply has started to increase, indicating that this rise in money supply is a positive development for Bitcoin. “Global liquidity is starting to increase, even though we see lower peaks, we are approaching a breaking point. The money printers are coming back, and interest rates are likely to fall soon,” he added.

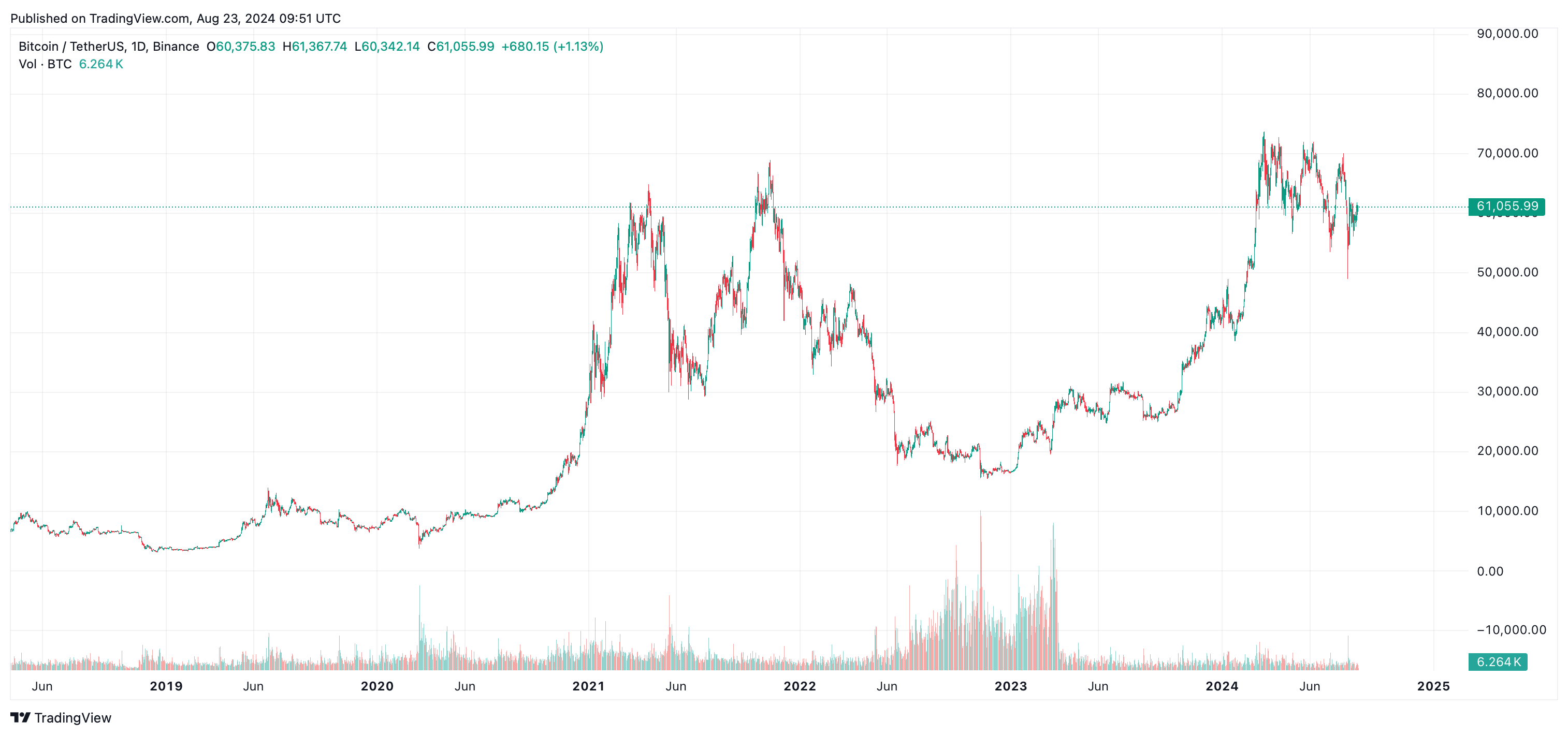

Evaluating Bitcoin’s current price movement on the monthly timeframe, Svenson pointed out that the current situation parallels cycles from previous years. The analyst stated, “Bitcoin is currently on a perfect path. What we see on the monthly chart is no different from previous cycles. Remember, in 2016, the block reward halving occurred, and a few months later, we reached new highs. The same scenario happened again after the halving in 2020. We are on a similar path post-halving in 2024. We haven’t reached new highs yet, we’ve just touched them, which actually shows that we are in perfect harmony with previous cycles.”

Positive Comment Alongside a Warning

Svenson noted that despite the volatility, Bitcoin’s current situation is quite good and is on suitable ground for new highs. The largest cryptocurrency was trading at $61,000 at the time of writing.

While uncertainty about Bitcoin’s future continues, Svenson paints a hopeful picture for investors. Given the highly volatile nature of the market, it is essential for investors to be cautious and shape their investment strategies accordingly.

Türkçe

Türkçe Español

Español