In the past three months, meme coins have made a significant impact and became the best-performing assets of the first quarter of 2024. The interest of new investors in speculative assets and the strong hype on the Solana network have shaped this outcome. If we’re talking about bull markets, we can say that meme coins can continue their impressive rallies (even if the players change).

BONK Coin

Investors who have seen massive gains in meme coins have learned to wait calmly with high profitability. We’ve seen this in many meme coins, and thus prices saw abnormal peaks as the demand increased while the supply for sale contracted. The situation is no different for BONK Coin, and the potential for rapid continuation with the start of the rally is strong.

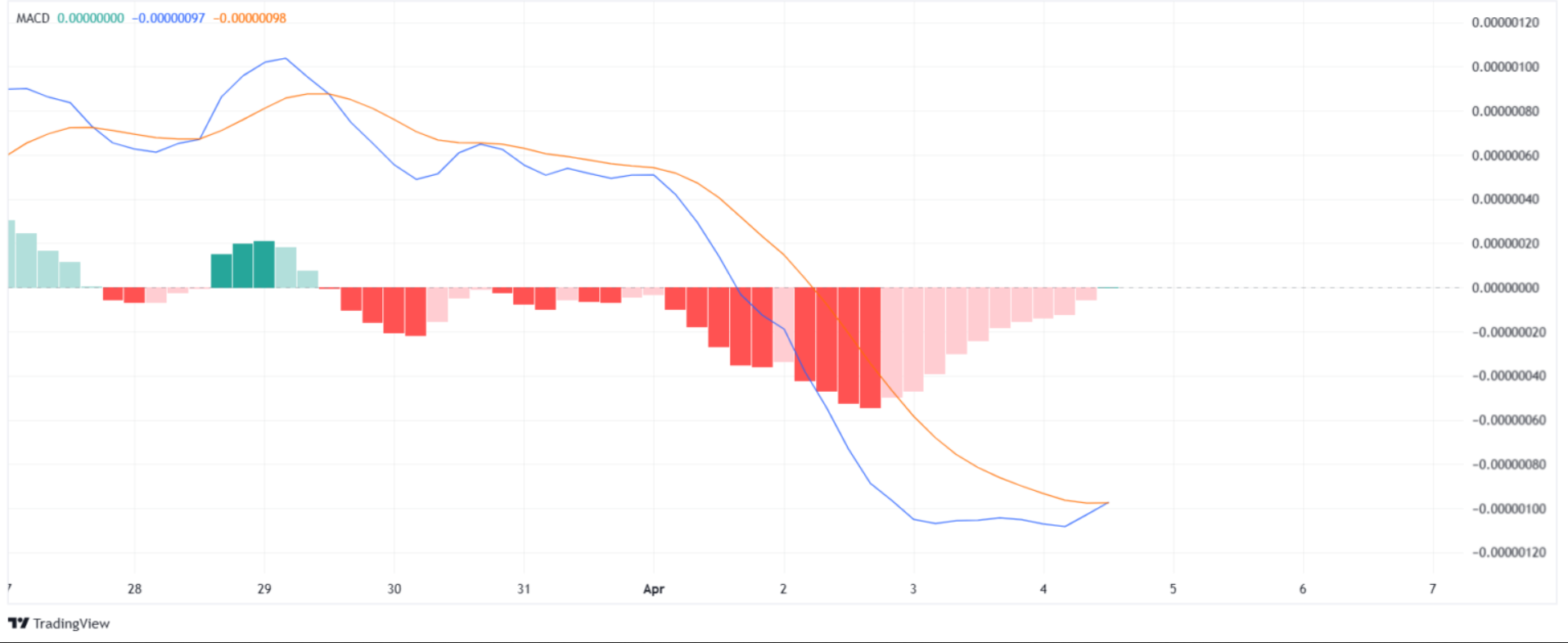

Despite the decline in BONK Coin price in futures, the funding rate remains positive, indicating that investors expect further increases. Moreover, the momentum indicator MACD used to determine trend directions also favors the continuation of the price increase. The MACD is currently marked with a green bar on the histogram, solidifying the potential bullish transition.

Furthermore, with Bitcoin‘s price moving further away from $60,000 today, a significant portion of altcoins have turned green. Some cryptocurrencies have achieved double-digit gains and are waiting for BTC to close above $69,000 to accelerate the rally.

The main snag here could be the SOL Coin price dropping below $185 and BTC struggling to close above $69,000. However, optimism continues specifically for BONK Coin.

BONK Coin Price Prediction

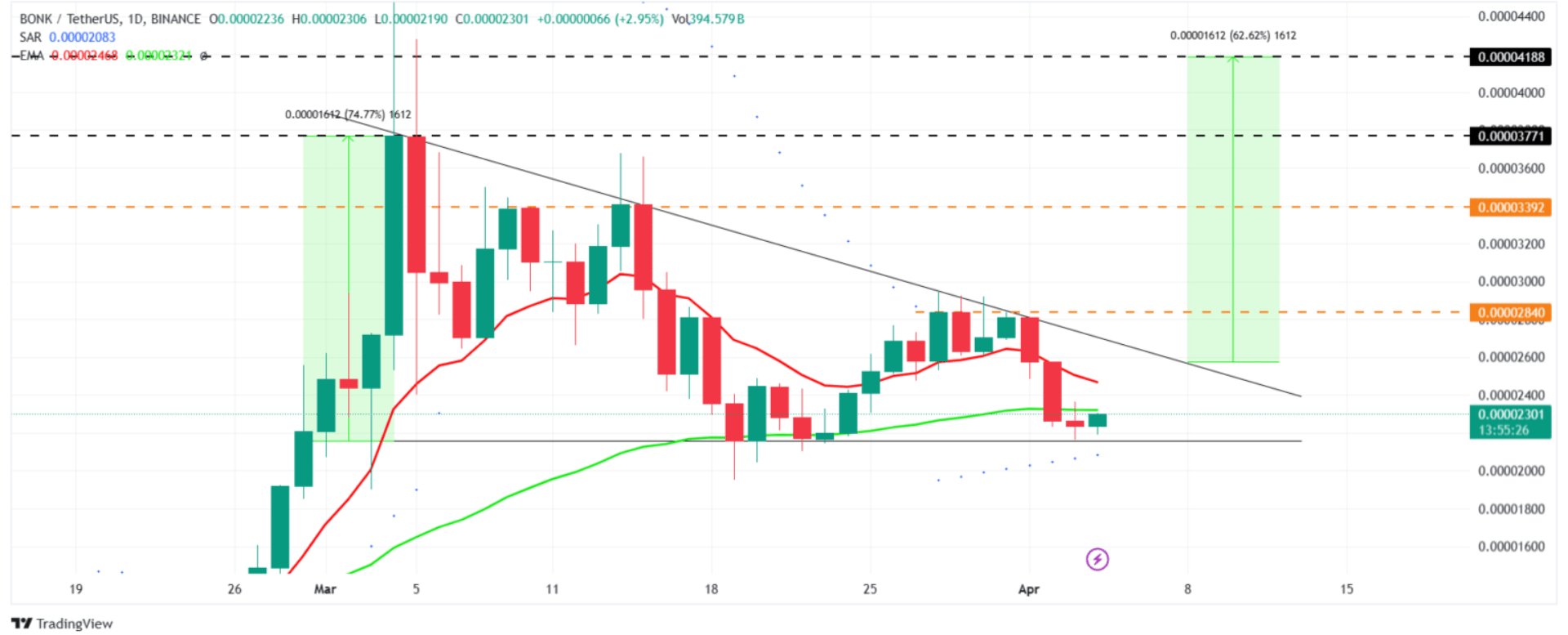

The price drop has settled, and BONK Coin is moving within a descending triangle formation. In the past, we have seen this formation lead to significant rallies in altcoins. If the scenario expected by optimists occurs and the triangle breaks upwards, the BONK Coin rally could begin.

Although there are multiple resistances to overcome with an upward breakout, the main target is approximately 62% higher at the $0.0000418 region. It’s important to know that open interest in futures continues to not increase. If this stems from a cautious stance among investors, the optimistic scenario could fail. Therefore, investors should also closely monitor the OI data.

Conversely, losing the support at $0.00002157 could trigger a loss of similar magnitude to the targeted peak. Since no one can see the future, it will be in investors’ favor to create their strategies and make decisions on their own.

Türkçe

Türkçe Español

Español