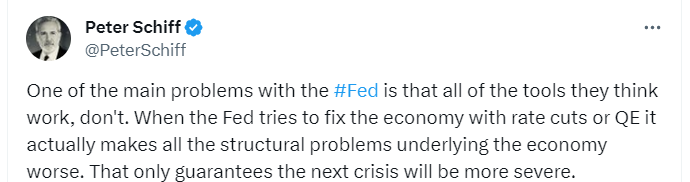

Bitcoin critic Peter Schiff highlighted a critical flaw in the Federal Reserve’s approach to economic problems in a recent statement. According to Schiff, traditional tools like interest rate cuts or quantitative easing (QE) employed by the Fed not only fail to address underlying structural issues but also exacerbate them, ultimately setting the stage for a more severe crisis in the future.

Navigating Economic Turbulence: The Bitcoin Perspective

This viewpoint challenges the dominant narrative that the Fed’s interventions are a panacea for economic troubles. Schiff argues that measures aimed at stimulating the economy could actually contribute to long-term instability. This claim prompts a closer examination of potential outcomes and raises questions about the effectiveness of traditional monetary policies.

In light of Peter Schiff’s warnings about the Fed’s limited effectiveness in managing economic downturns, investors are increasingly turning their attention to alternative assets like Bitcoin. The decentralized nature of cryptocurrencies and their detachment from traditional financial institutions position them as potential safe havens during turbulent economic times.

Often touted as “digital gold,” Bitcoin has shown resilience in the face of economic uncertainty. Unlike traditional fiat currencies, Bitcoin operates on a decentralized network, gaining immunity against manipulations by any organization, including central banks. This inherent feature has sparked interest among investors seeking protection against the potential pitfalls of traditional monetary policies.

Potential Bitcoin Rally: A Look Ahead

If Peter Schiff’s concerns about the Fed’s strategies prove correct, the cryptocurrency market, led by Bitcoin, could experience significant growth in the future. As faith in traditional financial systems wanes, investors may flock to alternative assets with greater stability potential.

The increasing adoption of Bitcoin by institutional investors adds weight to its status as a potential beneficiary during periods of economic uncertainty. Institutions looking to diversify their portfolios may turn to cryptocurrencies as a strategic move to reduce risks associated with traditional investment avenues.

Peter Schiff’s critique of the Federal Reserve’s traditional tools sheds light on the growing skepticism surrounding conventional economic strategies. As debates over the effectiveness of central bank interventions continue, Bitcoin emerges as a notable contender in providing a reliable alternative for investors navigating the unpredictable waters of economic downturns.

The future trajectory of Bitcoin’s value remains uncertain, but with influential figures like Peter Schiff challenging the status quo, the cryptocurrency’s role as a potential safeguard against economic instability gains significance. As investors reassess their portfolios against evolving economic landscapes, Bitcoin is poised to play a significant role in shaping the future of financial strategies.

Türkçe

Türkçe Español

Español