Notcoin (NOT) increased by approximately 40% in the last 24 hours and gained over 100% on the weekly chart. The recent significant rise trended alongside GameStop (GSTOP) on the CoinMarketCap trend list on May 30.

NOT Price Analysis

A recently published Notcoin price analysis report indicated that the Telegram-based Web-3 game token could achieve a 38% gain. According to the main technical chart indicators, the rally is far from being halted. Based on the rise in the relative strength index (RSI) indicator, NOT experienced strong buying pressure.

Additionally, as shown by the rise above the average level of the chaikin money flow (CMF) indicator, capital inflow into NOT markets increased from May 28. According to the obtained data, it shows an upward momentum for NOT’s price. Moreover, the rise above the 0.0095 dollar level at the 38.6% fib level could force the market structure into an upward trend in a lower time frame, indicating the possibility of further increases.

Analytical Reports on NOT

NOT could gain an extra 14% if it surpasses the recent high of 0.012 dollars at the 0% fib level in the next few hours or days. However, liquidity heat maps indicated that a short pullback towards the approximately 20-day EMA cannot be ruled out. Coinglass liquidation data showed significant liquidity clusters around 0.011 dollars and 0.013 dollars on the 24-hour chart. Overall, market makers’ manipulation could lead to a liquidity hunt at both the nearest and farthest levels from the current price level.

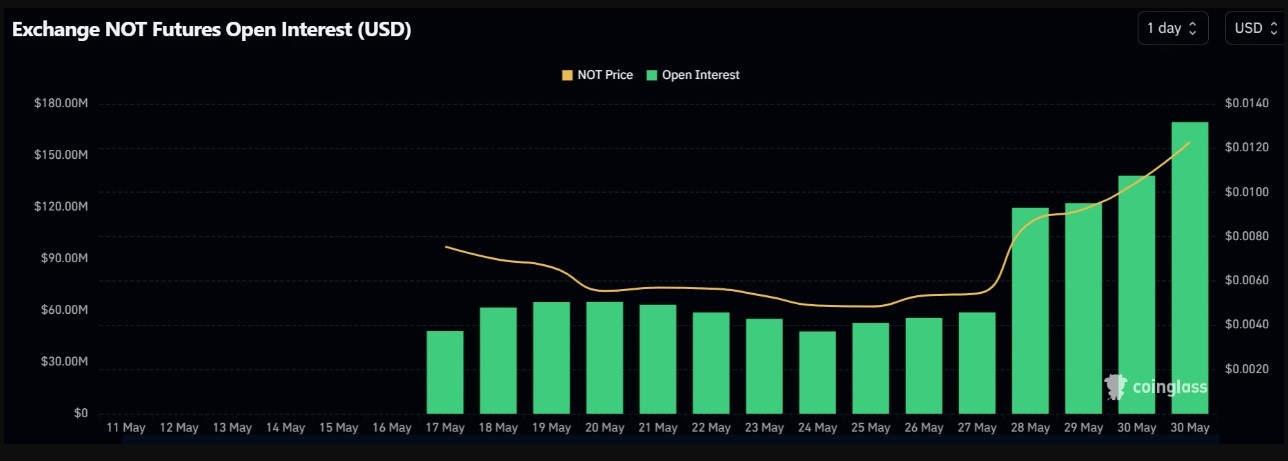

If the scenario occurs, NOT could reach 0.013 dollars before attempting to surpass the recent high and slightly drop to 0.011 dollars. Such a slight pullback could serve as a discounted buying opportunity for sidelined bulls due to the bullish signal from the derivatives market. The significant increase in open interest (OI) could further strengthen the strong bullish sentiment towards NOT in the derivatives markets. It could indicate more capital flowing into NOT’s market, highlighting that most participants expect further price increases.

Türkçe

Türkçe Español

Español