The lawsuits filed by the U.S. Securities and Exchange Commission (SEC) against the giant cryptocurrency exchanges Binance and Coinbase, as well as the identification of several altcoins such as Solana (SOL), Cardano (ADA), and Cosmos (ATOM) as securities, are moving the confidence of investors in the cryptocurrency market towards worrisome levels. Gwei Research, formerly known as 8BTCnews, reported that DWF Labs, a global digital asset investment firm, amassed over $1.55 million worth of assets in twelve altcoins on centralized cryptocurrency exchanges (CEX). Here are those altcoins.

DWF Labs Transfers Millions in 10 Altcoins to Exchanges

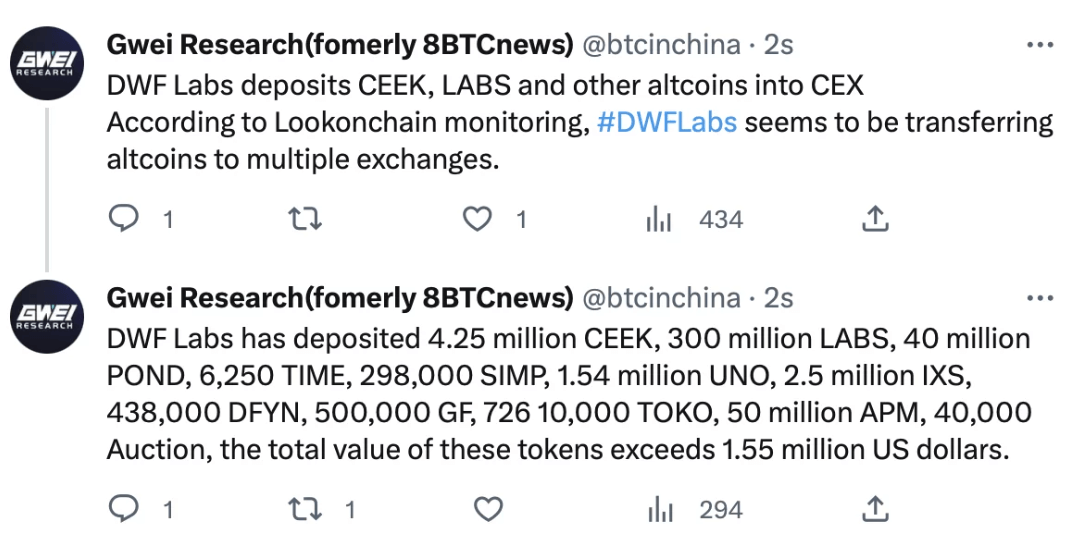

According to Gwei Research, the global digital asset investment firm DWF Labs transferred from twelve altcoins including CEEK and LABS to exchanges. Referring to the transmission of on-chain data tracker Lookonchain, Gwei Research pointed out that DWF Labs transferred the aforementioned altcoins to multiple centralized cryptocurrency exchanges.

According to on-chain data, the company deposited 4.25 million CEEK, 300 million LABS, 40 million POND, 6250 TIME, 298,000 SIMP, 1.54 million UNO, 2.5 million IXS, 438,000 DFYN, 500,000 GF, 10,000 TOKO, 50 million APM, 40,000 Auction to centralized cryptocurrency exchanges. The total value of all these altcoins exceeds $1.55 million at current prices.

What Does DWF Labs’ Move Mean?

The transfer of coins or tokens held outside of the exchange by an investor or a company to centralized cryptocurrency exchanges is generally considered a preparation to sell. This situation shows that the probability of DWF Labs selling in CEEK, LABS, POND, TIME, SIMP, UNO, IXS, DFYN, GF, TOKO, APM, and Auction is quite high.

Both centralized and decentralized cryptocurrency exchanges provide the opportunity for users to buy and sell various altcoins by listing them. This process usually involves users transferring altcoins from their cryptocurrency wallets to the wallets of the cryptocurrency exchanges. Thus, users can buy, sell or swap altcoins by trading on exchanges.

Market observers suggest that investors of these altcoins should be cautious against a potential sales pressure.