Solana has emerged as one of the most popular smart contract platforms of the 2021 bull season. The NFT frenzy has further fueled its growth. With its affordability and speed, the Solana network has attracted numerous investors, many of whom have made transactions at least once. However, the network now faces competition from over 10 rivals, and the collapse of FTX has resulted in the loss of its biggest financial supporter. This situation is reminiscent of Binance‘s struggle to continue its operations after its bankruptcy, with BNB Chain. However, the situation is not exactly the same for Solana because it does not have an official network like FTX.

Solana Review

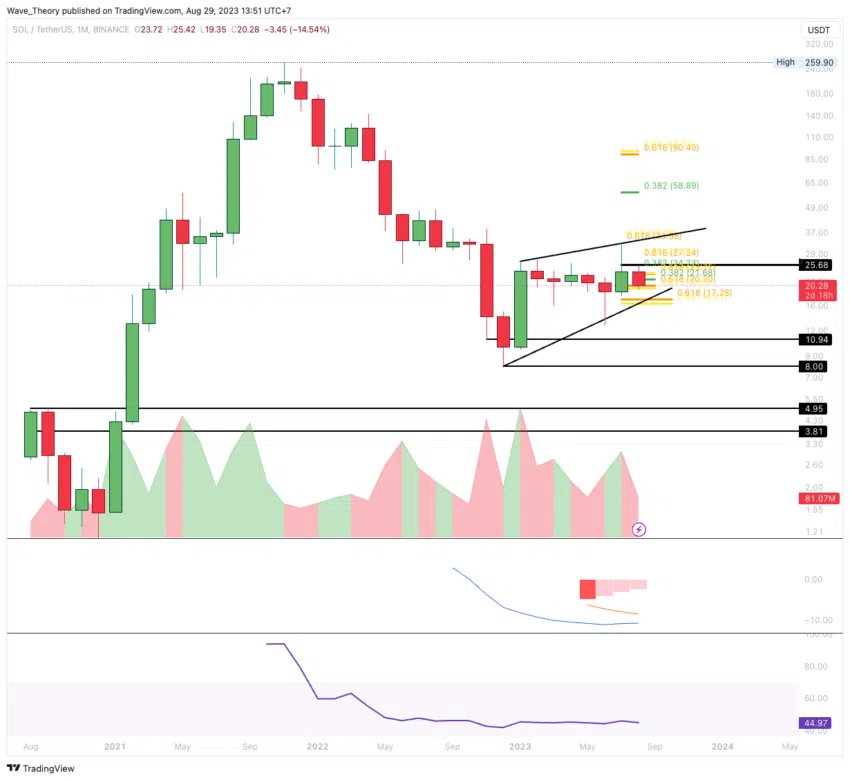

Solana’s price has reached a critical value of $20. The daily chart indicates further losses as it shows a death cross in the EMAs. The price drop from $32 to $20 has been heavily influenced by the overall market negativity. Readings that strengthen the short-term downward trend on both the 4-hour (4H) and daily charts are pushing investors to look for the next support level.

The continuity of Solana’s corrective movement may continue as long as the $27.5 region, accompanied by the 50-week EMA as an additional resistance, is not breached. In the scenario where the decline continues, the price may drop to $17, leading to further sales. If this support level can be maintained, it may present an opportunity for price recovery after short-term sales.

SOL Coin Price Prediction

If Solana loses support at $17, a further decline process could occur, reaching as low as $8. In this case, we may also see the BTC price drop to the $23,500 range. For the acceleration of sales below $17, the general market sentiment negativity will need to support it. The base support is between $8 and $11, with additional support below $5.

In the BTC pair, SOL Coin has broken the support level of 0.0008227. This indicates an increase in losses against BTC. If the decline continues, we may see a drop to the 0.000695 level in the BTC pair. Despite the rise of the MACD lines, the MACD histogram has shown a decline for three weeks, and the RSI has remained in the neutral zone. This indicates that the downward movement against BTC will continue.

Of course, technical analysis does not predict the future, but the continuation of the ongoing selling pressure does not provide a clear roadmap for SOL Coin.