In the past 24 hours, it has garnered significant attention, potentially becoming a foremost layer1 solution subsequent to Aptos. Mere hours ago, we discussed the projections of a high-ranking SUI Coin executive for the future. Presently, we shall delve into the figures. What uncertainties surround the eagerly awaited Sui (SUI) Coin launch?

Sui (SUI) Coin Introduction

This token frequently draws comparisons to Aptos, a reasonable association given their shared MOVE language. The price was anticipated to be proportionate, with the $2 target long established. Impressively, the token reached two dollars on the Binance exchange today. Nonetheless, certain supply-related specifics have been neglected. For instance, APTOS possesses a maximum supply of approximately 1 billion, whereas SUI Coin’s supply is 10 billion. Thus, if we are to contrast prices, the outcome is as follows:

- SUI Coin Price according to Aptos circulating supply: 2.5 dollars

- SUI Coin price according to Aptos maximum supply: 1 dollar

Aptos is valued at $10, boasting a circulating supply of $1.9 billion. SUI Coin currently trades at $1.4, with a circulating supply of 528 million.

Numerous crypto behemoths have invested in SUI, including Coinbase, Jump Trading, Circle, and others. This factor further likens it to Aptos.

Sui (SUI) Coin Unveiling

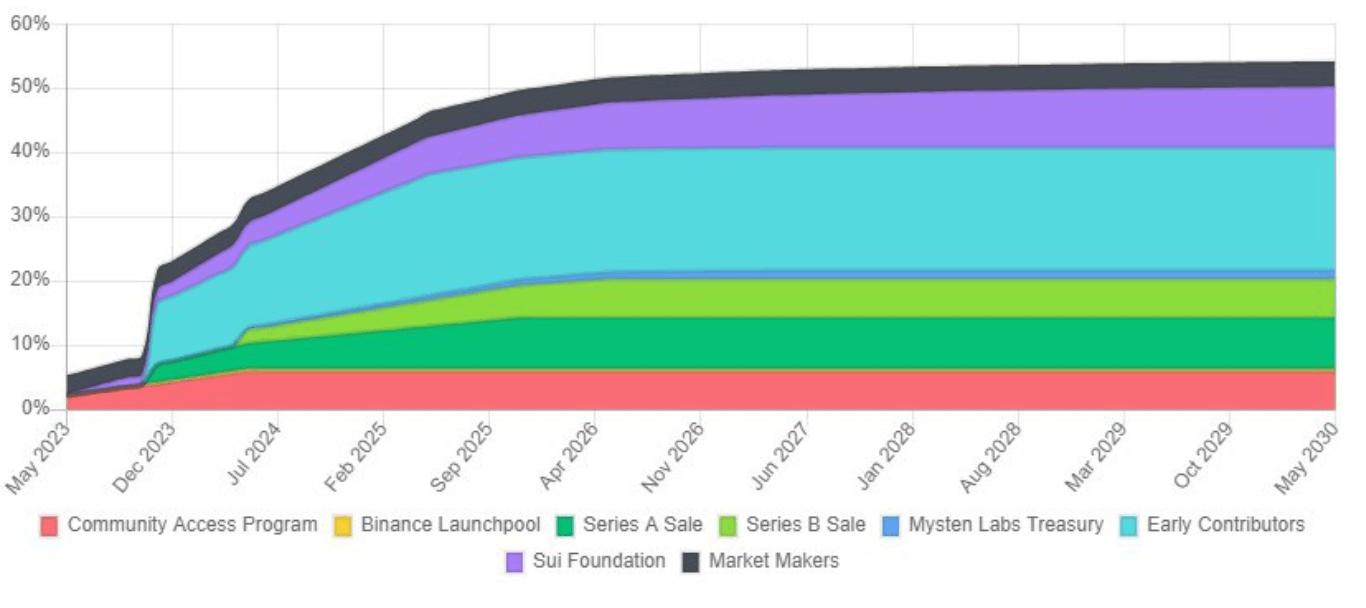

In discussing institutional investors, unlocks promptly spring to mind. Sui (SUI) Coin, retaining a substantial portion of its supply locked for now, will gradually unlock it. As with numerous other cryptocurrencies, its supply will not remain constant, and the price must decrease if demand fails to match the rate of circulating supply expansion. A common error amongst traders is neglecting the circulating supply for the relevant period when analyzing the price chart. If the supply available for sale grows and demand does not follow suit, the price should decline.

By the close of 2023, SUI Coin will release approximately 533 million tokens. At the prevailing exchange rate, this equates to nearly 746 million dollars. In rough terms, the circulating supply will double, and if the supply escalates while investors do not correspondingly increase, or if unlocks transform into sales, the price must decline by half.

Sui (SUI) Coin, projected to possess a circulating supply of 1 billion by the end of 2023, distributed its total supply in the following manner:

- 45.77% Community Reserves

- 20% Early Stage Investors

- 10% Mysten Labs Treasury

- 8% Series A Investors

- 6% Series B Investors

- 4.5% General Public Sale

- 3.95% Market Maker

- 1.38% Allowlisted General Sales

- 0.4% Binance Launchpool

On the 3rd of each month, assets of investors who made partially locked purchases on the exchange will be released.

Ultimately, the aforementioned scenario materializes at the unlock. It remains to be seen whether Sui (SUI) Coin can consistently maintain demand as the circulating supply surges expeditiously.