The uncertainty in the cryptocurrency markets is expected to dissipate at least in the short term with the help of Fed statements. While many experts anticipate high volatility during Powell’s remarks, some altcoins have shown positive divergence in the process. In fact, their gains have exceeded 150%.

Why is Tellor (TRB) Surging?

Amidst the need for the LINK token price to rise, good news has caused an increase in its competitor’s price. Following a major pullback over the weekend, the price of Tellor (TRB) has started to move above the $40 level today. On-chain and technical readings indicate that the TRB Coin price could reach $50 in the short term.

Tellor (TRB) is an oracle protocol. As investors focus on the Real World Assets (RWA) sector this month, TRB, Chainlink (LINK), and other major players in decentralized oracle projects have become the center of attention. The involvement of trillions of dollars worth of giants, including Citi, in tokenized assets, increases interest in this field. The recent test conducted by Swift with Chainlink also supported the price increase. However, the TRB Coin price outperformed LINK, which has become a monopoly in the sector.

TRB Coin Price Prediction

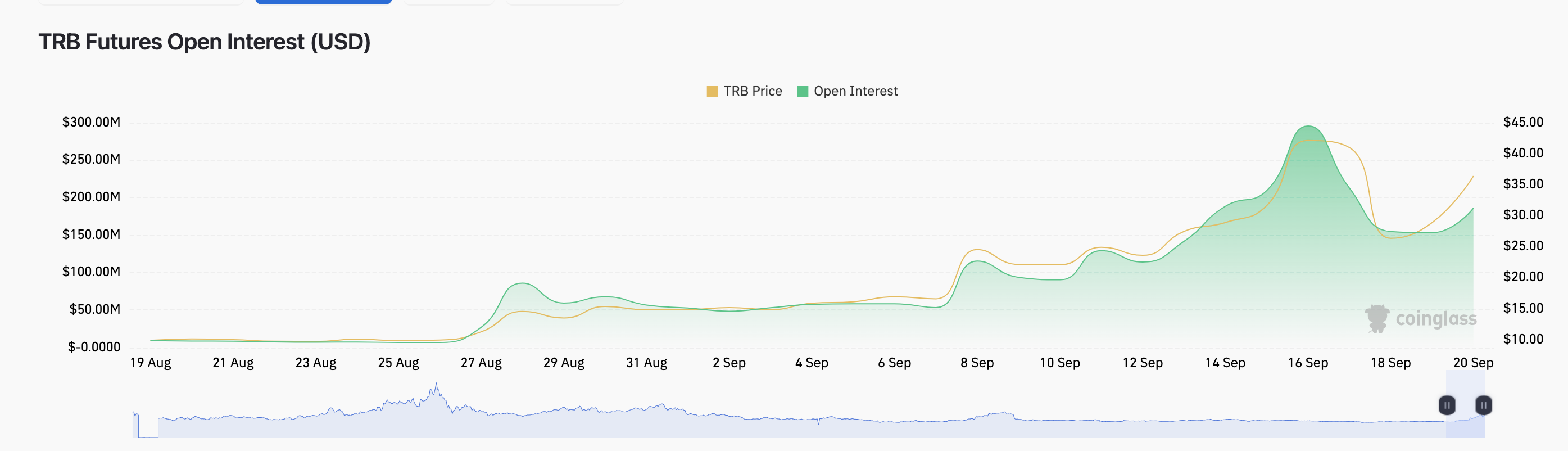

In the past few days, we mentioned that the rise of TRB Coin was fueled by short-term speculators. Subsequently, the price dropped to $26 on Monday and today it tested $40. Interestingly, traders in derivative markets remained relatively unresponsive to this move. Capital inflows increased by only 21%. Despite the 53% price increase, the relatively weak increase in open interest remained subdued.

Due to the underperformance of the rise, the open interest in TRB Coin may soon decline. In fact, according to Santiment data, Tellor is struggling to attract new users. Only 62 new TRB wallet addresses were created on September 20, which represents a 66% decrease compared to the previous day. In summary, if the overvalued TRB Coin price continues to fail in attracting new participants, it may cause the bubble to burst.

Depending on the tone of the Fed meeting and if it surpasses $40, we may see the test of $50. However, considering the negativity in BTC and Powell’s hawkish tone at the time of writing, a price decrease is a stronger possibility. In the event of a possible downtrend, the strongest support zone is at $20.

Türkçe

Türkçe Español

Español