For crypto investors, the expectations for June and July were quite different. However, things didn’t go as planned, and there is something worrisome on the horizon. The Fed isn’t worried for now, as the last time they were, inflation was running in double digits. Powell, who claimed that it was temporary back then, had a major misconception.

What Happens in a Recession?

Recession, or economic downturn, is something that crypto investors should be concerned about. It can significantly impact the market in a negative way. A recession signifies a substantial slowdown in the economy, with a decrease in production and an increase in unemployment. Two consecutive quarters of negative growth indicate a technical recession. The US experienced this and emerged from it, but experts don’t think the same way.

In the second part of the article, we will extensively discuss the expectations of a recession in the US economy. This is a period that crypto markets have not yet experienced. If crypto, which moves in sync with stocks, does not differentiate itself positively during this period, it may suffer significant losses. When people are mostly focused on survival and facing financial difficulties, they are unlikely to enter risk markets. Perhaps this is why cryptocurrencies have started to gain traction in the second half.

Despite developments such as BlackRock, Bitcoin, which has not increased significantly, may be pricing in its future.

US Heading Towards a Recession

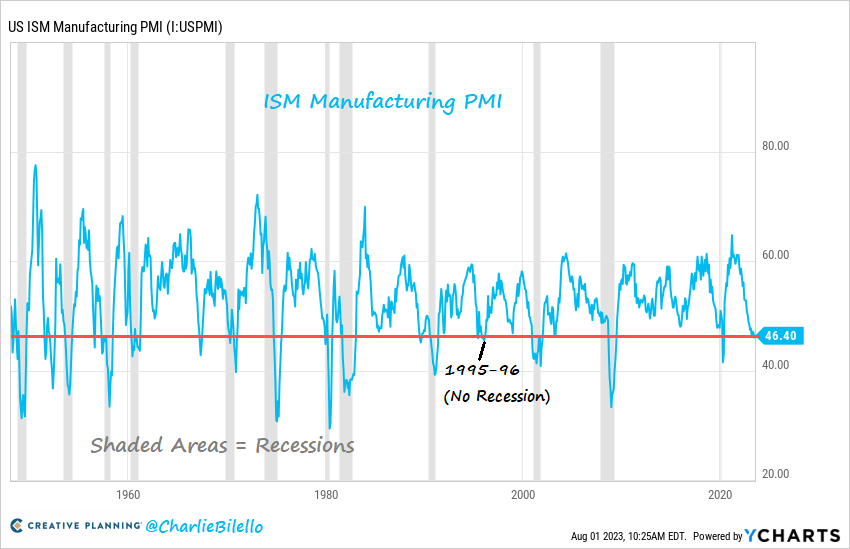

Bloomberg analysts and Charlie Bilello believe so. Bilello, a well-known figure in macroeconomics, emphasized the inevitability of a recession with the PMI chart he recently shared. If the experts are right, while the Fed pays the price for excessive tightening with a recession, cryptocurrencies may experience an unprecedented downturn in proportion.

The renowned macroeconomist said:

“The last three times the ISM Manufacturing PMI was this low, the US economy was in a recession or on the verge of one. To find a lower value without a recession, you have to go back to 1995-96. How is it possible for there to be a decline in the manufacturing sector without a general economic downturn in the US?”

Justyna Zabinska-La Monica, Senior Director at The Conference Board, said last month:

“When the June data is considered together, it indicates that economic activity will continue to slow down in the coming months. High prices, tighter monetary policy, harder-to-obtain credit, and decreasing government spending are all preparing to further reduce economic growth.”

What about the Fed? Powell is doing what he did when inflation started to rise in 2021. Back then, he called inflation temporary and now, with a target of 2% by 2025, he says they are not expecting a recession. This is even more concerning.