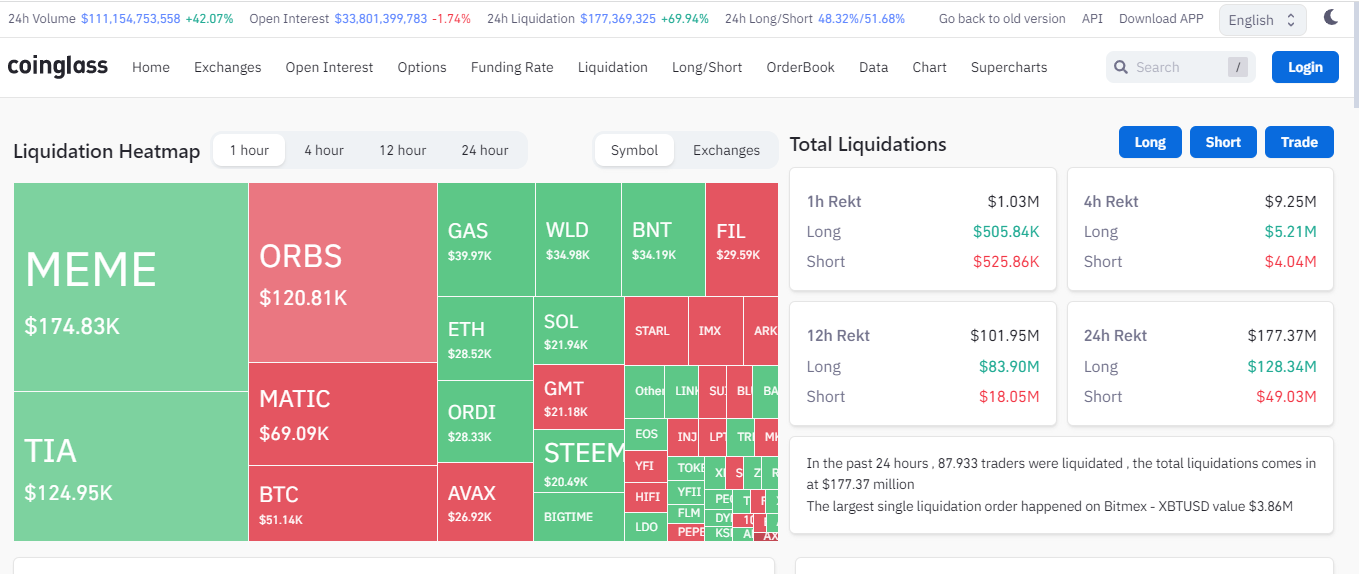

The crypto market finds itself in the midst of a corrective phase after the recent volatility. In the past 24 hours, total liquidations across the network have reached nearly $200 million. Long positions, in particular, took a significant hit with $128 million being liquidated. This correction has affected over 97,000 users. It also highlighted widespread adjustments in the market. Specifically, the largest single liquidation occurred on Bitmex XBTUSD, totaling $3,869,000.

Understanding Massive Crypto Liquidations

As the crypto market experiences this correction, analyzing the key metrics contributing to the $200 million liquidation becomes crucial. As we have emphasized in our previous reports, there seems to be a resurgence in the market following the recent upward wave. The anticipated correction due to the volatile movements necessitates cautious moves for long positions. The liquidation of $128 million worth of long positions signifies a significant shift in sentiment.

Bitcoin and altcoin markets pose challenges for investors during correction periods, as they face increased volatility and the need to manage risks. It is worth noting that making effective decisions during these challenges can be extremely difficult.

Identifying New Entry Points

As the market recalibrates, experienced investors often see corrections as opportunities. Analyzing market trends, identifying potential support levels, and understanding overall market sentiment become crucial elements of a strategic approach. Therefore, the loss of millions of dollars provides new entry points in terms of crypto market dynamics.

In conclusion, the approximately $200 million liquidation in the past 24 hours serves as an indicator of the inherent volatility in the crypto market. However, it is important to note that this situation further solidifies the foundations of the recent market surge. It is now crucial for traders to develop proactive strategies for the next phase.