In the midst of the bear market that started and expanded in the first half of 2022 for the cryptocurrency market, most cryptocurrency holders are being punished with losses. However, among the top 20 cryptocurrencies by market capitalization, there are three layer-1 blockchain tokens that have suffered the most losses.

The Top 3 Altcoins with the Most Losses Among the Top 20 Cryptocurrencies!

According to data from IntoTheBlock, more than 93% of Cardano (ADA), Polygon (MATIC), and Avalanche (AVAX) holders, three layer-1 blockchain tokens, are in a position where they have lost in purchases where the average dollar purchase cost is higher than the respective price of each crypto asset.

In particular, Ethereum (ETH), the leading layer-1 blockchain, is in a majority winning position, with 43.67% in losses and a better long-term performance compared to its latest competitors. At the time of writing, ETH was trading at $1,626, ADA at $0.25, MATIC at $0.54, and AVAX at $9.94.

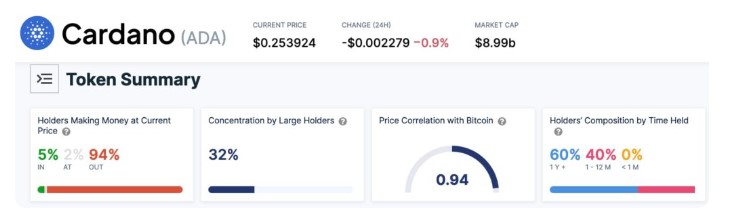

Cardano (ADA) Current Status

Cardano has become the largest cryptocurrency by market capitalization among these three layer-1 blockchains competing against Ethereum. It stands out as the only cryptocurrency among these three that is not EVM compatible. In terms of collected data, 94% of ADA holders are in a loss position. 2% are in a break-even position (neither gaining nor losing), and 4% of Cardano holders are making profits from their average purchases.

Interestingly, only 32% of the total supply is held by addresses that have more than 0.1% of the circulating supply. The majority of the remaining 60% consists of long-term holders who have held their tokens for more than a year.

How Much is Polygon (MATIC) Worth?

Polygon started its journey in the crypto world as a layer-2 blockchain for Ethereum but soon detached itself from the Web3 leader to create its own ecosystem, for better or worse.

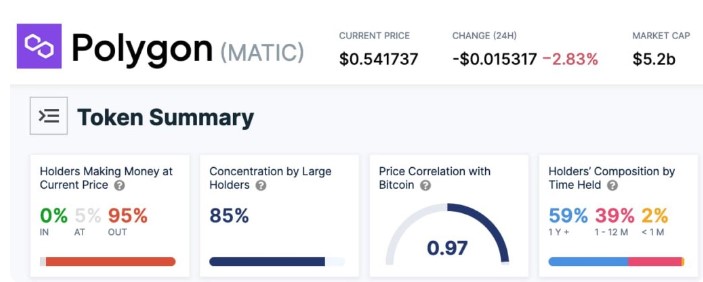

Surprisingly, MATIC has the second worst performance among these three projects. 95% of its holders are in a loss position and shockingly 0% are in the green. The data shows that 5% of Polygon’s investors are in a break-even position.

Although a similar composition of holders has been holding their positions for more than a year (59% for MATIC and 60% for Cardano), 85% of Polygon’s circulating supply is held by whales. They are classified as such because they hold more than 0.1% of the current supply.

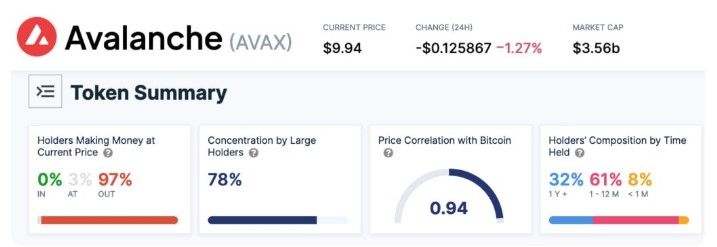

Avalanche (AVAX) Holders

Avalanche stands out as the newest project among these three. According to CoinMarketCap, it is the 19th largest cryptocurrency by market capitalization and positioned as the 15th largest cryptocurrency among the projects tracked by the IntoTheBlock dashboard.

Similar to MATIC, AVAX also has very few holders in profit. However, there are fewer investors who can equalize their purchase prices in a hypothetical sale, as 97% of them have unrealized losses.

Avalanche has a slightly better distribution among whales (those holding at least 0.1% of the supply) compared to Polygon and has captured 78% of the circulating supply. As expected from a relatively newer layer-1 blockchain compared to its competitors, the majority of holders (69%) have only held their positions for less than a year.