Experienced crypto market commentator Tom Lee says Bitcoin is on track to reach $150,000 in 2024. Fundstrat Global Advisors’ managing partner and head of research Lee revealed his latest bullish Bitcoin price prediction in an interview with CNBC earlier this month. Bitcoin has no shortage of optimistic price targets this week, but some observers are focusing on the long term.

Bitcoin Continues to Gain Momentum

Among those who share these thoughts is Tom Lee, who stated that Fundstrat sees a six-figure Bitcoin price as a base case this year. The renowned expert commented:

“We think Bitcoin is still at the beginning of a bullish cycle, so the idea that it could reach $150,000 this year is still within our base case.”

Such a price could be double the current all-time highs, which were reached in March before dropping to $56,000 earlier this month. Explaining his rationale, Lee pointed to macroeconomic changes coming from the US.

The Federal Reserve’s language regarding interest rate cuts, a key issue followed by risky asset investors, is more optimistic than where the market stands. Lee is known in crypto circles for Bitcoin price predictions that do not always come to fruition. In the long term, he hinted to his followers on X this week that Bitcoin has been delivering. The BTC/USD pair was trading around $70,000, up 15% from the beginning of the month, according to TradingView data at the time of writing.

What Is Happening on the US Front?

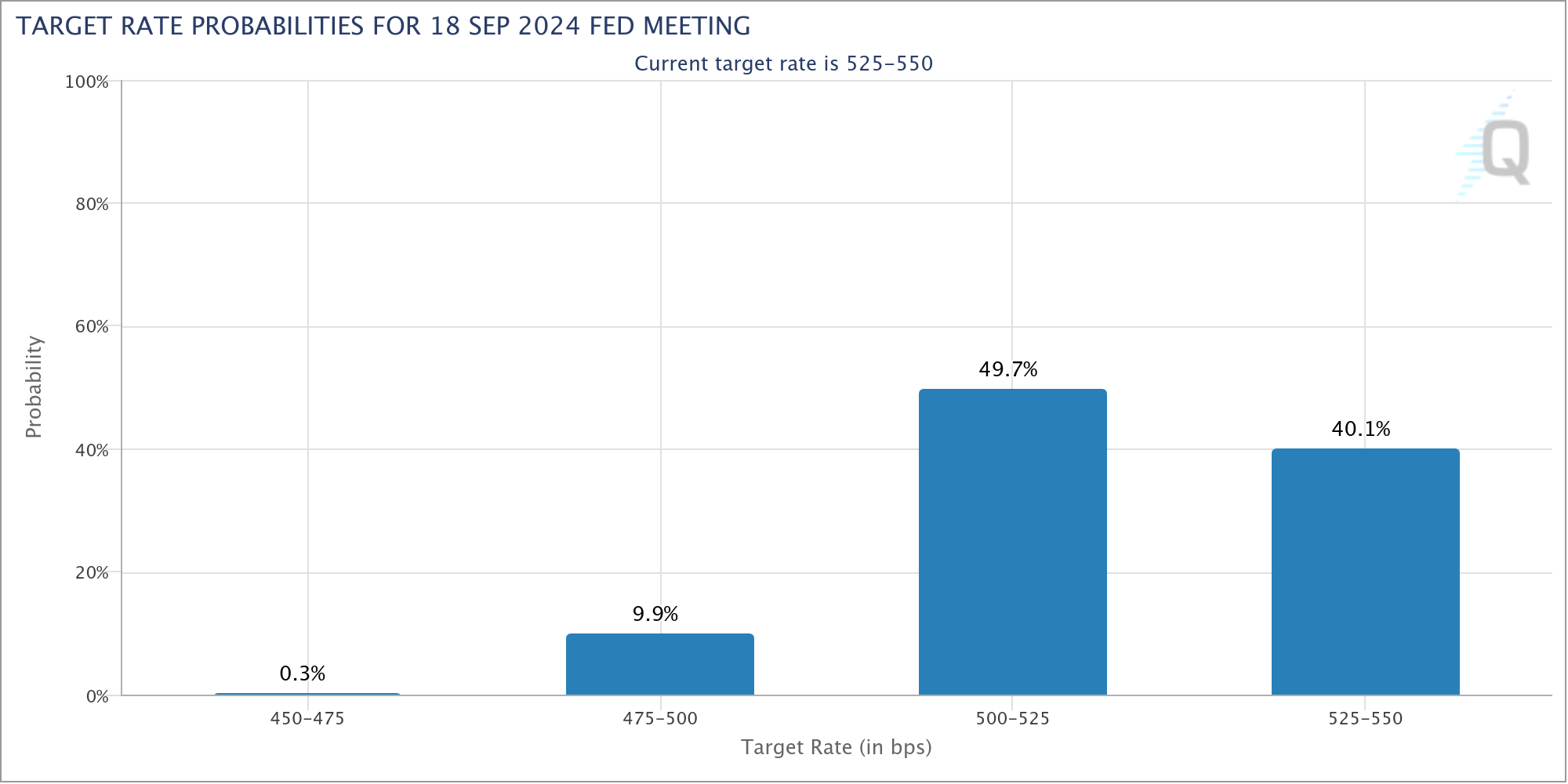

Meanwhile, the latest forecasts from CME Group‘s FedWatch tool show that markets believe the most likely option for a rate cut is at the Federal Reserve’s September meeting, not earlier. The minutes from the Federal Open Market Committee’s (FOMC) May meeting, released this week, also emphasized that no policy direction is off the table:

“Participants discussed that if inflation does not show signs of moving sustainably toward 2% or if there is unexpected weakness in labor market conditions, the current restrictive policy stance would need to be maintained for a longer period.”

“Various participants mentioned that if risks to inflation materialize in a way that warrants such action, they would be willing to tighten policy further.”

Türkçe

Türkçe Español

Español