The Turkish community holds a distinct place among global cryptocurrency investors. This bear market has proven that. The intense interest from investors led to the opening of TRY trading pairs on exchanges like Binance, while many fiat currency pairs were removed. Turkish investors largely did not shy away from crypto even in the midst of a bear market. So, what’s the situation today?

Cryptocurrencies Favored by Turks

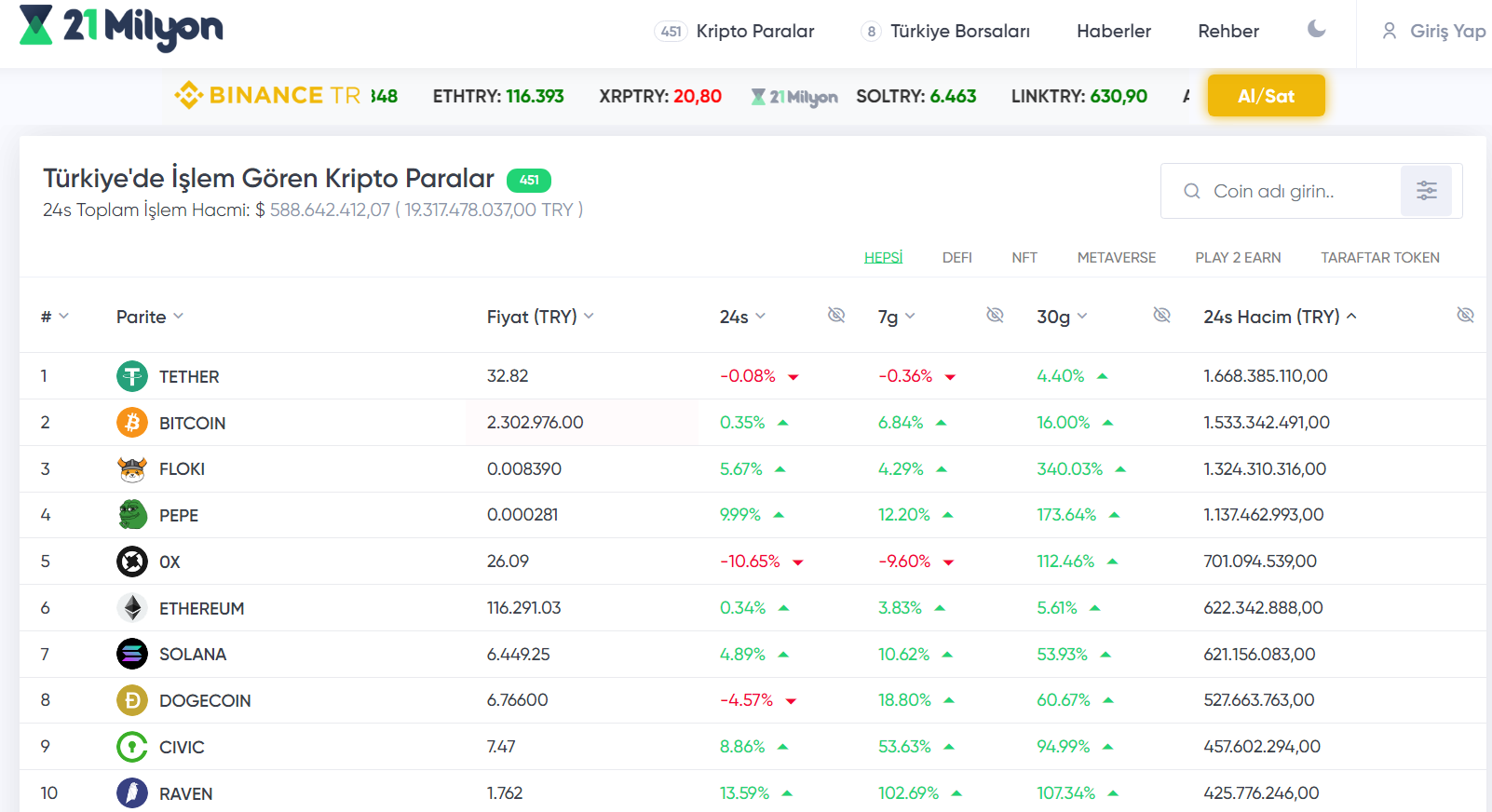

There are millions of cryptocurrency investors in Turkey, and even local crypto exchanges alone are witnessing massive volumes. Considering their activity on global exchanges, the role of Turkish investors in the global market becomes clearer. In the local exchanges alone, a volume of 19.3 billion TL was reached in the last 24 hours.

Borsa İstanbul, the Istanbul Stock Exchange, had a cumulative volume of 93.7 billion TL on Friday. Today, local crypto exchanges are drawing roughly 20% of that volume. Of course, it’s not possible to collect this data by visiting all the exchanges one by one. Instead, we use 21milyon.com to monitor Turkish investor trends in real-time.

Top 10 Cryptocurrencies

As the importance, power, and influence of Turkish crypto investors grow, it’s easy to see which altcoins are garnering more interest. When you visit the cryptocurrency tab on 21milyon.com, you see a list of the cryptocurrencies with the highest volume. Here, you can also view volume, price, and the rate of gain/loss over certain periods (24 hours, 7 days, 30 days).

When we look at the list of most popular cryptocurrencies, a detail that does not match the global exchange data immediately catches our attention. Turkish investors, being more open to risk, have placed FLOKI Coin as the third most traded cryptocurrency. PEPE and others have also entered the list with their high-risk, high-reward potential.

While these highly volatile altcoins can sometimes yield good returns, they can have devastating effects when they fall. Not withdrawing during bear markets and making loss-making sales during bull markets, only to try to catch up with the price again, can lead to losses for investors. This situation can especially cause new investors in highly volatile assets to suffer significant losses in a short period.

Türkçe

Türkçe Español

Español