Bitcoin price is not in a better position than yesterday, trading at $67,400 as this article is being prepared. Investors were focused on upcoming data from the US, and recent figures indicate that the strong stance in employment continues. So, has the downturn ended?

Bitcoin (BTC)

BTC has been struggling with bearish sales in the $69,000 region for a while, and for now, the key area has not been reclaimed. Popular crypto analyst Daan Crypto Trades mentioned in his latest market assessment that Bitcoin has been hovering around the highest level of the 2021 cycle for about four weeks. So, what does this mean?

Historically, Bitcoin tends to linger near its cycle peak for about 1-2 months before price movement resumes. This stagnation, which began in the pre-halving period, doesn’t seem so illogical when viewed within the context of historical data. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

On the other hand, shallow retracements are positive for the uptrend. While avoiding deeper lows, BTC is consolidating at lower levels and gathering strength for new peaks. Of course, there are many triggers for this. For example, Genesis selling its billion-dollar GBTC shares and inflation data coming in negative for the past two months.

Glassnode analyst Checkmate reminded us that during the previous bull market cycle between 2019 and the end of 2021, Bitcoin experienced two corrections greater than 50%. However, the pullbacks in the current bull phase have been milder, which is another development feeding optimism for the current period.

Bitcoin (BTC) Commentary

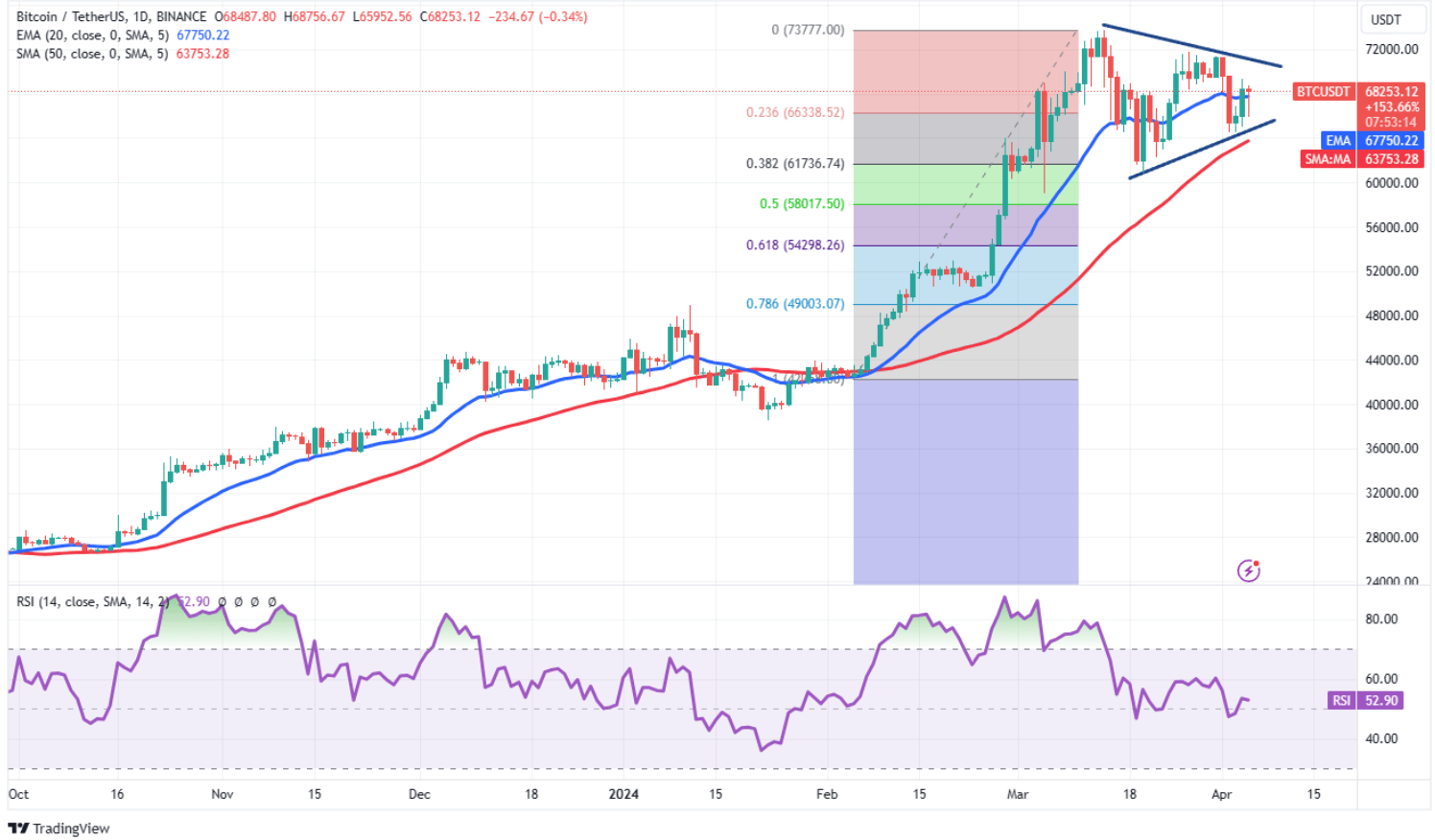

Buyers and sellers are keeping the price in balance. Neither has yet to gain the upper hand as we haven’t seen a new breakout at either $60,000 or $73,777. Moreover, the symmetrical triangle forming on the chart suggests that a breakout is imminent.

The 20-day flat EMA ($67,750) and RSI close to the neutral zone do not provide a clear advantage to the bears. Depending on the breakout of the triangle, an increase in volatility is expected for BTC and cryptocurrencies in general.

If the symmetrical triangle breaks downwards, a retest of the $60,000 support followed by a drop to $54,298 is expected. Conversely, if it breaks upwards, a target over $73,777 could lead to an $80,000 objective.

Türkçe

Türkçe Español

Español