Crypto markets continue to be exposed to positive trends due to the ongoing increase in BTC price. What’s exciting is that despite the negative developments in the macro landscape, cryptocurrencies manage to maintain their strong position. On the other hand, there is growing optimism that the bear market has come to an end as BTC continues to reach new highs. So, what do crypto analysts think? Today, let’s take a look at the failed predictions in October instead of focusing on the experts’ current forecasts.

The Worst Crypto Analysts

Approximately 11 hours ago, the price of Bitcoin reached the $36,000 mark and then retraced. Currently, it is finding buyers above $35,200. In October, there were three analysts who stood out with their bold predictions. Let’s examine their predictions and how they failed.

TheMoonCarl

He is at the top, and back in mid-October, he shared a chart showing the downward break of BTC price from a rising parallel channel. The crypto analyst, who drew attention to the break, pointed to a target of $25,000. Analysts cannot predict the future and can make mistakes, and TheMoonCarl is one of the closest examples of this.

Instead of falling, the price actually rose to the $36,000 level.

RektCapital and Profit8lue

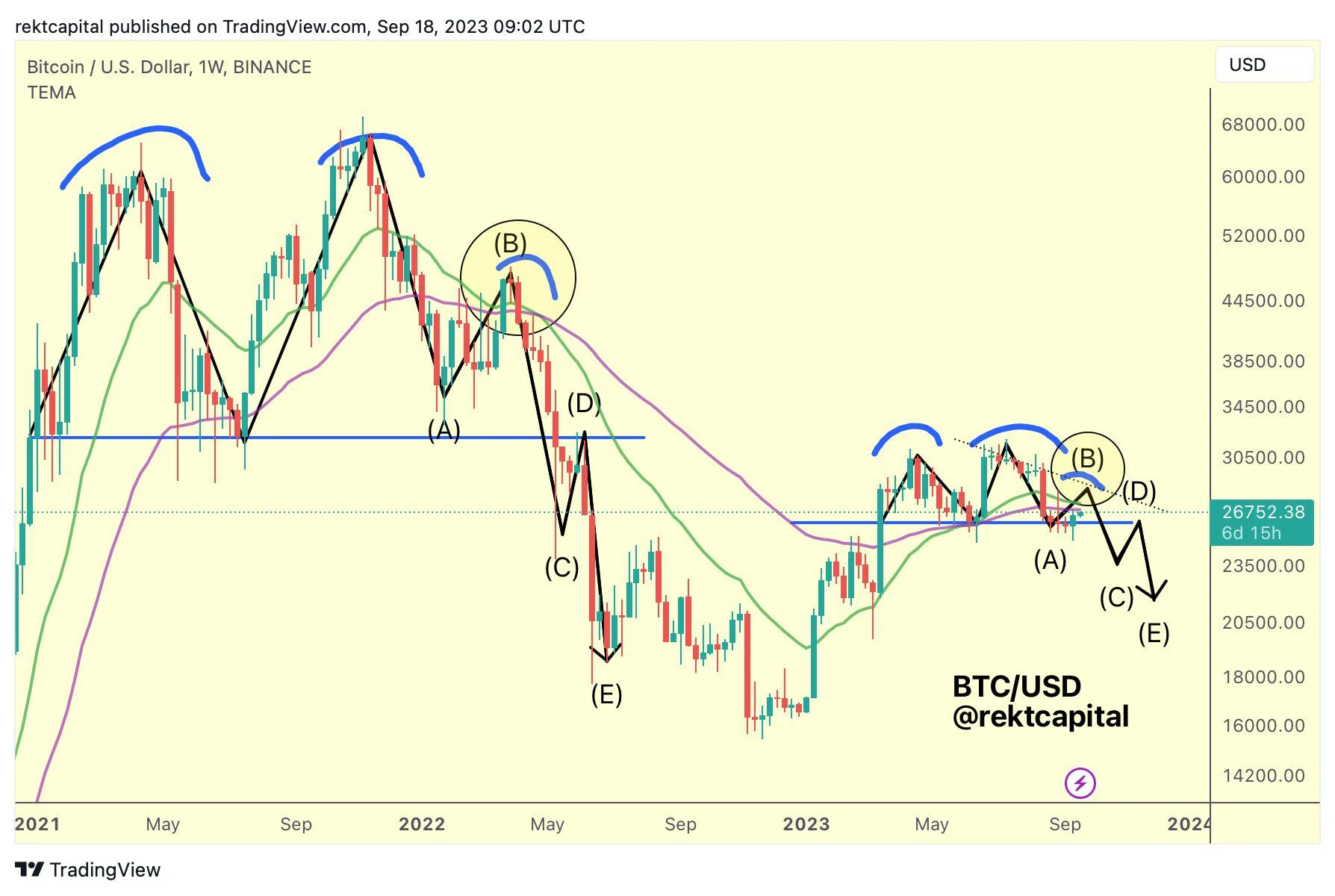

Among the three analysts, the most popular one was Rekt Capital, known for accurately predicting previous major price movements. Although Rekt Capital emphasized several times that the long-term target was a strong uptrend, he made incorrect predictions about pre-halving performance. We should know that just because an analyst makes correct predictions several times does not mean everything they say will be right forever. Rekt Capital is a recent example of this. Capo for 2023 and PlanB for 2021 can be the best examples.

While RektCapital predicted a drop to $20,000, Profit8lue argued that the price would fall to $12,000. Analysts still believe that resistance rejection at the $35,000 level could push the price down to $31,300 and below.

Cryptocurrencies are full of surprises, and predictions can be invalidated when prices stubbornly decide to move in a different direction. Therefore, investors should only see analysts’ opinions as an opportunity to “look at the market from different perspectives.”