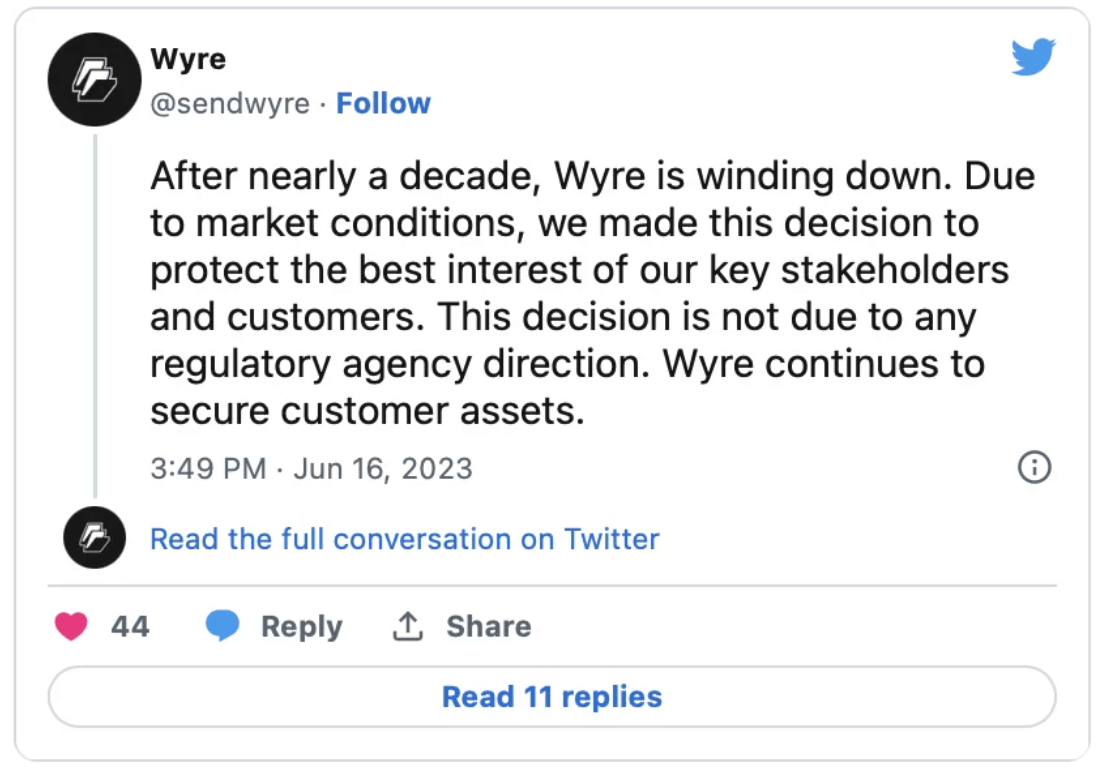

Crypto payment company Wyre, based in San Francisco and serving for over a decade, announced on June 16th that it is shuttering due to the financial difficulties caused by the ongoing bear market. The firm clarified that its decision was not related to any US regulatory authority.

Wyre’s Closure

In a blog post, Wyre stated it had made a difficult decision to best protect the interests of its key stakeholders and customers. It continued, “Wyre continues to secure customer assets. If you have assets on the platform, you can continue to withdraw them via Wyre’s control panel until Friday, July 14. After that date, a separate process will be initiated to recover any remaining assets on the platform.”

Wyre’s team also mentioned that the company’s assets are currently available for purchase, stating, “If you’re interested in buying Wyre’s or its affiliates’ assets, please reach out to 88 Partners.”

The company has faced significant challenges since one-click payment company Bolt cancelled its plans to acquire Wyre for $1.5 billion in September 2022. A few months later, problems began to surface when fiat-to-crypto ramp solution provider Juno invited users on January 4 to withdraw their cryptocurrencies from the Juno platform and their custody due to the uncertainty surrounding Wyre. The next day, MetaMask discontinued its support for Wyre’s crypto payment services citing the same issue.

Only a few days later, Wyre began implementing a 90% withdrawal limit for all its users. Still, on January 13, with funding from an unnamed strategic partner, the company lifted the 90% limit, leading to claims of the company’s recovery. Nevertheless, Wyre was forced to lay off 75 employees in January.

Crypto Winter Continues to Hit Crypto/Blockchain Companies and Projects

With its decision, Wyre has added itself to the growing list of crypto/blockchain companies and projects affected by the harsh crypto winter pressure caused by the ongoing bear market.

Just in May, crypto fintech firm Unbanked, Lightning Network payment platform BottlePay, cryptocurrency exchange HotBit, NFT platform Terressa, and the Digital Currency Group’s (DCG) institutional trading platform TradeBlock shut down.