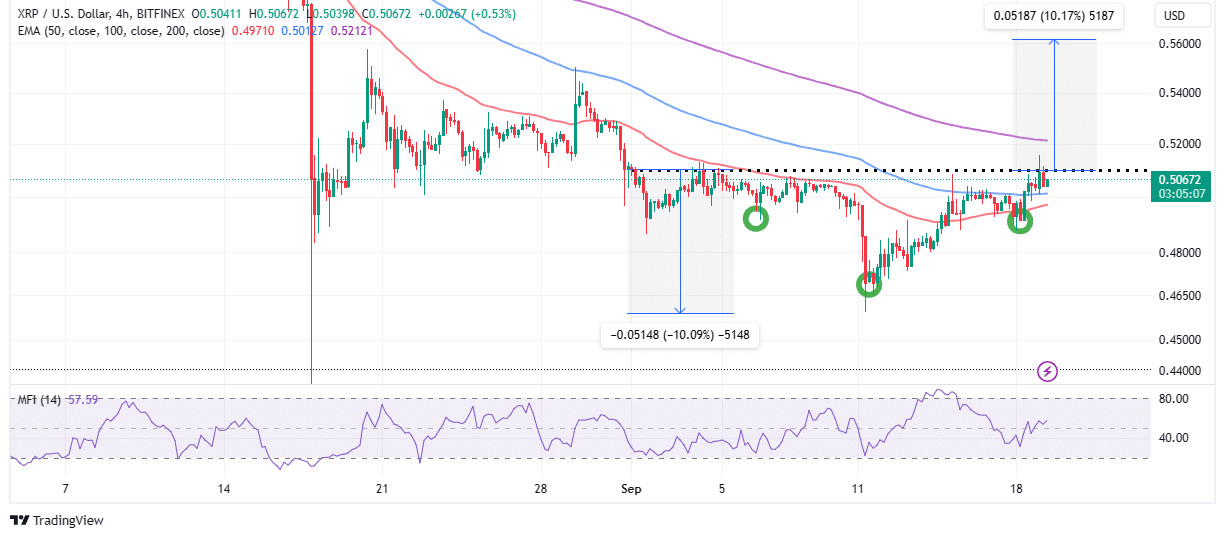

Popular altcoin XRP‘s price rose by 2.5% to $0.5095, placing it among the best-performing cryptocurrencies. The cross-border money transfer altcoin is preparing for the next upward movement above $0.5 and is currently focused on the first breakout target, which is the psychologically important $1 resistance level that will pave the way.

XRP Bulls Pursue Upside with Reverse Head and Shoulders Formation

The price movement characterized by the initial drop to $0.4588 in September followed by a recovery has created a reverse head and shoulders formation. The confirmation of the expected breakout above the $0.51 neckline resistance could push XRP’s price to $0.56 with a 10% movement.

The reverse head and shoulders formation is the opposite of the regular head and shoulders formation. When the formation is confirmed and works, the downtrend reverses and gives way to an uptrend. Investors wait for the price to break above the neckline resistance before placing buy orders and moving towards the target level of the formation.

While XRP bulls strive to gain above the $0.51 resistance, they are also struggling to defend the $0.5 support at all costs. The Money Flow Index (MFI) indicates the dominance of buyers. Moreover, if the entry volume in the MFI, which compares the amount of money entering and exiting the XRP markets, continues to surpass the exit volume, XRP will inevitably sustain its uptrend. Furthermore, reaching the overbought zone above 80 on the MFI will signal the need to close long positions or proceed with caution.

Indicators like SuperTrend reinforce the bullish outlook for XRP price. This index takes into account the Average True Range (ATR) to measure market volatility. XRP price staying below the ATR implies that the path of least resistance is upwards.

For the bulls to continue exerting pressure, XRP price needs to trade above the monthly opening level of $0.5115. With this level transforming into stronger support, XRP will be in a better position to explore the reverse head and shoulders formation and push for gains above $0.56. The next significant obstacles for the price will be $0.85 and $1. Additionally, investors should focus on the daily timeframe’s support area at $0.5033, which also serves as short-term support. A daily candle closing above this level can act as a catalyst for XRP to continue its upward trend and reach $1.

The 100-day EMA (blue) at $0.5013 and the 50-day EMA (red) at $0.4971 will serve as additional support levels if the price of XRP falls and breaks below the $0.5 support.

XRP Price Could Find Support from Positive Developments

While Ripple celebrates its partial victory against the U.S. Securities and Exchange Commission (SEC) in July, the XRP community is now focused on the other anticipated victory party expected at the end of this month.

Various announcements, including the disclosure of Ripple’s potential IPO and reaching an agreement with the SEC to avoid going to court, are expected. XRP’s price is expected to perform even better with all these developments.

Türkçe

Türkçe Español

Español