Famous analysts who have made accurate predictions in the past are being closely followed by investors. One of the experts who correctly predicted previous major movements shared his expectations regarding the current situation. BTC is currently at $27,100 as this article is being prepared. The September closing was above the $26,950 support.

Analyst Who Anticipated the Bottom

He correctly predicted the price crash in 2022 and the subsequent rally period. Now, in an environment where uncertainty prevails once again, he is warning investors. The famous crypto analyst known as DonAlt says that the recent rise is fueled by the approval of ETH ETFs. However, he believes that this is not sustainable.

“If you look at the daily chart of Bitcoin, you will see that we have returned to the resistance cluster. Honestly, I wouldn’t care too much about this because we have tested it twice before the third test… But what I don’t like is the market going to resistance with bullish news in my eyes. After the news that triggers the rise, the price quickly unravels and loses its strength. I don’t like the current outlook of the market.”

DonAlt also emphasizes that crypto futures products have historically brought significant declines to digital asset markets.

“I also think that people in general forget how Bitcoin future ETFs have performed. If you show them on the chart, it doesn’t look good. I also think that people in general forget how Bitcoin future ETFs have performed. If you show them on the chart, it doesn’t look good. This basically ended the bull market. If I remember correctly, there was another one quite close to the peak in 2021. Overall, our track record is not very good, so my mind is very confused.”

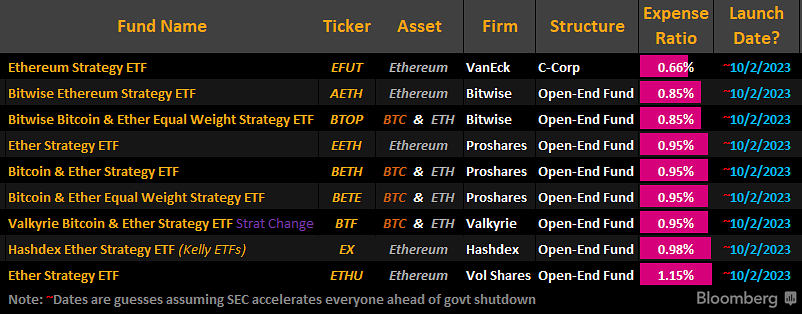

Launch of Crypto ETFs

On Monday, 9 different crypto ETFs will be launched if there are no surprises. Some of them will be products directly related to ETH, while others will be products evenly distributed between ETH and BTC. You can see the details of the ETFs expected to start trading on Monday in the table below.

The Chicago Mercantile Exchange (CME) became the first institution to launch Bitcoin futures when BTC reached $20,000 in December 2017. In October 2021, ETF provider ProShares received approval for its own ETF and 1 month later BTC reached its all-time high. This was followed by a bear market that lasted for nearly 2 years, and we are still in it.

Türkçe

Türkçe Español

Español