ETH, XRP, SOL, and all other cryptocurrencies need an increase in BTC price in order to experience impressive rallies. Bull markets start with an increase in BTC price, followed by altcoins. The negative environment that has been ongoing for almost 2 years has led to one of the longest bear seasons for cryptocurrencies. Moreover, the power of sellers has increased with chain bankruptcies.

How Much Will Bitcoin Be?

It is difficult to accurately determine transition periods in the cryptocurrency markets. Therefore, those who want to jump on the train at the right time usually become famous for their face downfalls. Although it did not surpass the resistance of $28,000, BTC is struggling to maintain the support of $27,200 in October. There are many events that support the possibility of markets rising, such as volume declines, BTC holdings on exchanges, halving, and ETF approvals.

So, if there are no surprises and we experience a bull market in 2024-2025 as in previous cycles, how much can Bitcoin be? We are considering the opinions of three different experts on this matter.

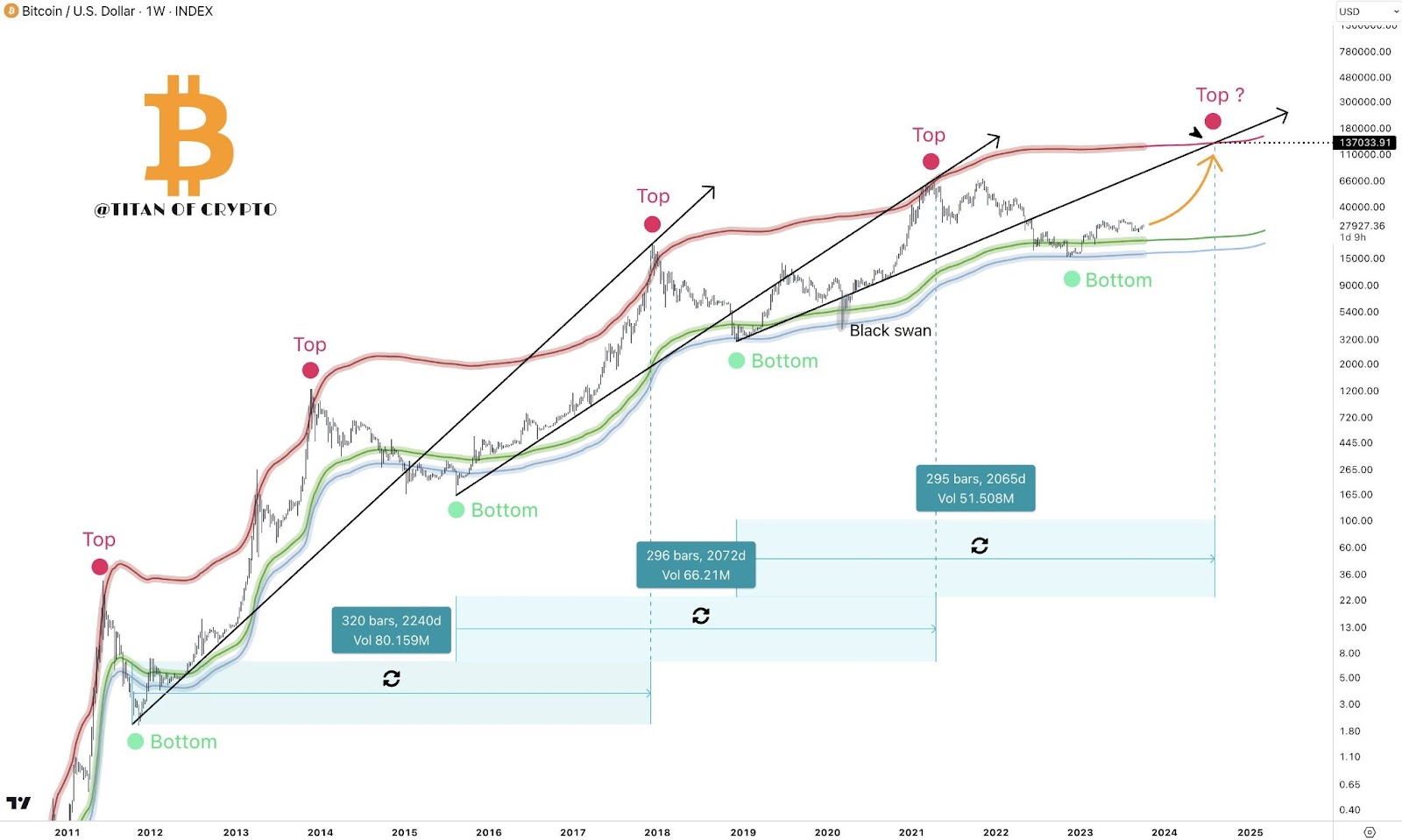

Will Bitcoin Reach $137,000?

According to Washigorir, the price of BTC can reach $137,000 within a year. His estimate suggests that the price will set a new ATH level in early dates such as August 2024, shortly after the halving. The halving is expected to take place on April 17th.

The analyst uses two methods for his bold Bitcoin price peak estimate. The first one is the realized price indicator of BTC, which divides the realized market value by the current supply.

The second method is diagonal trend lines, which connect the bottom of the previous cycle and the top of the next bull.

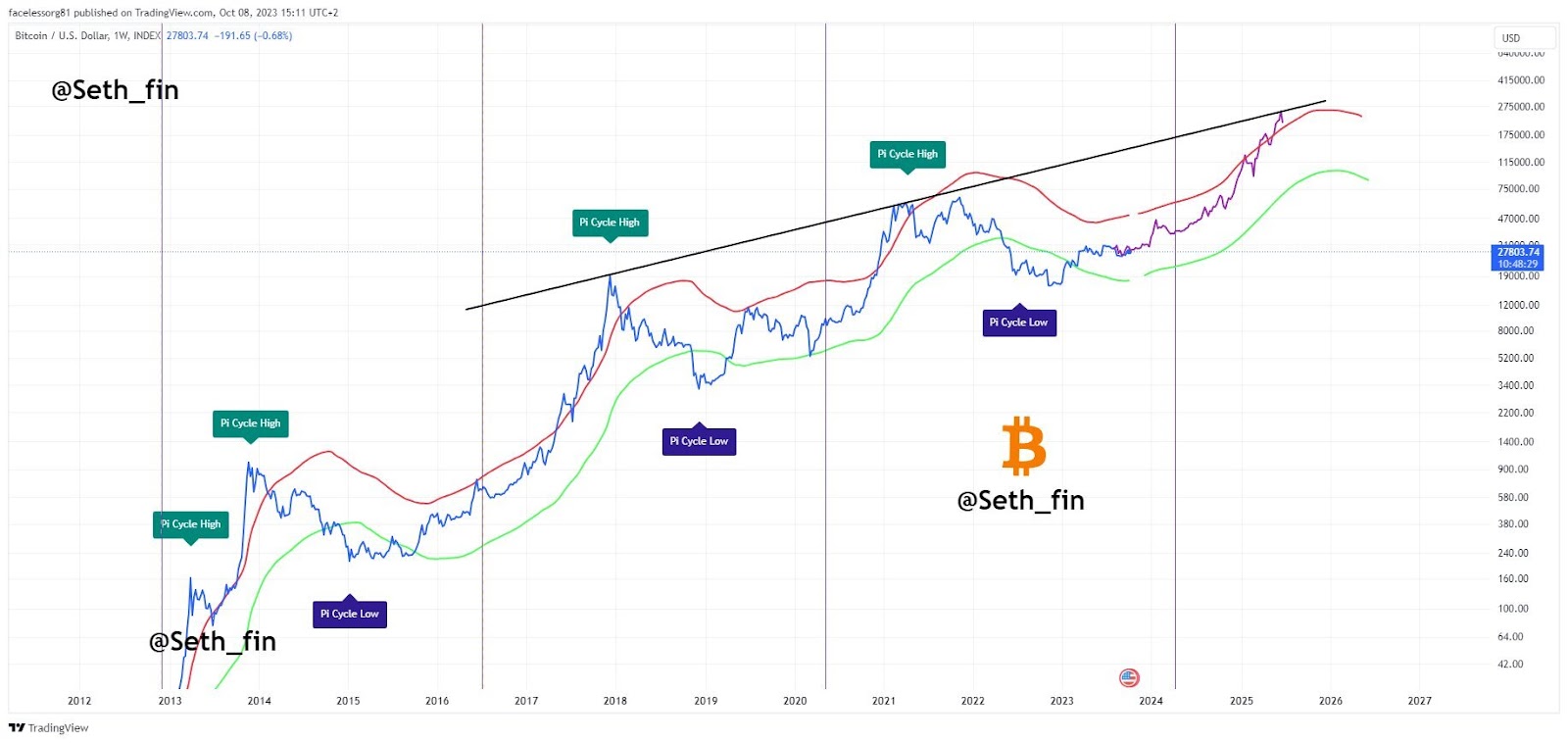

Will Bitcoin Reach $250,000?

If Washigorir’s prediction seemed ambitious, let’s take a look at the view from seth_fin. In his chart, he uses the famous Pi Cycle indicators for both market tops (red) and market bottoms (green). This is a prediction based on four-year cycles. Historically, the BTC price reaches its historical peak 12-18 months after the halving.

According to seth_fin, at the end of a mature bull market, Bitcoin will likely end its upward trend at a point between $200,000 and $250,000.

How Much Will Bitcoin Be?

The final prediction comes from CryptoYoddha. The analyst uses a long-term parallel channel for his price prediction. The upper range (red) indicates the area of past and future peaks. The lower range (blue) indicates the area of market macro bottoms.

The most important part of CryptoYoddha’s analysis is the fractal similarity with the previous cycle. Unlike the previous analysts, this analyst expects the surpassing of the old ATH level before the halving. This means that we can see a peak around $72,000 before April.

The ultimate peak target is above $200,000.

Of course, all these predictions do not take into account the regulatory pressure on cryptocurrencies, ongoing and upcoming wars, rising oil prices, sticky inflation, and the hawkish Fed with increased tightening risk. Cryptocurrencies have had very difficult days in the past, but for the first time, the Fed is seen this hawkish, which could invalidate performance-based predictions. Perhaps Bitcoin will reach six-digit price targets next year without caring about any of these. Only time will tell.

Türkçe

Türkçe Español

Español