Comments continue to be made about the Bitcoin ETF, which has remained uncertain for the past few months and is expected to rewrite the fate of the entire cryptocurrency market.

Founder of Pantera Capital, Dan Morehead, made a statement about why the ETF is so important in a recent post. On November 21, Dan Morehead, managing partner of Pantera Capital, predicted the approval of a spot Bitcoin ETF in the near future and discussed its potential impact.

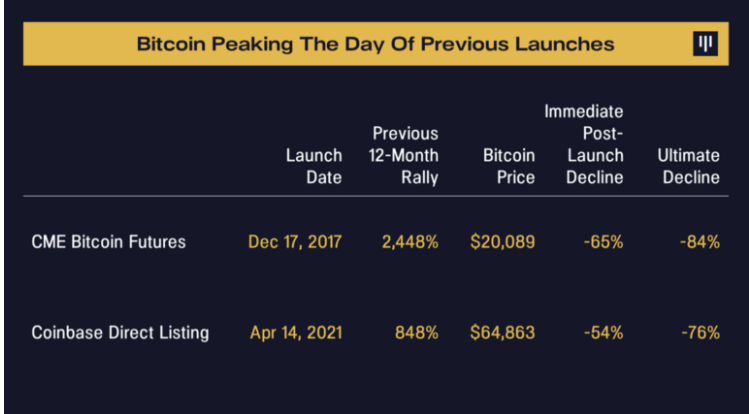

The old Wall Street saying “buy the rumor, sell the news” clearly worked in the crypto market after two major regulatory announcements. When Bitcoin futures trading started on the CME in December 2017, it marked the peak of the $20,000 bull market. In early February, BTC had lost 65% of its value.

Furthermore, on the day of Coinbase’s IPO in April 2021, the price of BTC was around $65,000, but it had lost 54% of its value by July of the same year.

During this period, speculators bought the rumor and sold the news. In addition, BTC futures trading did not open the markets to new investors and only provided a small amount of arbitrage opportunity during this period. Also, changes in the ownership of Coinbase shares did not pose a problem for accessing Bitcoin.

This is different. The BlackRock ETF is fundamentally changing access to Bitcoin. It will have a very significant (positive) impact.

According to the statement made by the Pantera executive, opinions that several spot BTC ETFs will be approved within a few months are increasingly strengthening. Contracts on the Chicago Mercantile Exchange support futures crypto ETFs. In addition, a spot product is also supported by the underlying asset itself. Therefore, issuers will need to buy BTC to offer potential contracts to their customers.

Comparisons with Spot Gold ETF

The existence of an ETF is a very important step towards becoming an asset class. When an ETF exists, if you are not exposed to it, you are effectively short.

Analysts compare this process to the launch of the first spot gold ETF in November 2004. With the ETF making gold a valid investment, demand for the asset quickly increased. By the end of 2011, gold prices had risen by more than 300% to $1,800 per ounce.

If BTC demand witnesses a similar movement to that of gold, it could potentially rise to $150,000 in the next few years. Bitcoin is currently trading at $37,363.