At the time of writing, Bitcoin’s price, having soared past $28,000, has retracted back below $27,600. This short-lived climb brought joy to investors, who are now hoping for a resurgence of volatility, thus spurring price growth. But what does this recent slump tell us?

Why is Bitcoin Falling?

The primary reason for this can be encapsulated in a single phrase – “shallow liquidity combined with risk-averse investors, who, uncertain about future data, are selling off, pushing the market downward”. That is, those investors skeptical of a rise are avoiding potential surprise data that could depreciate the market, and are instead pocketing their profits.

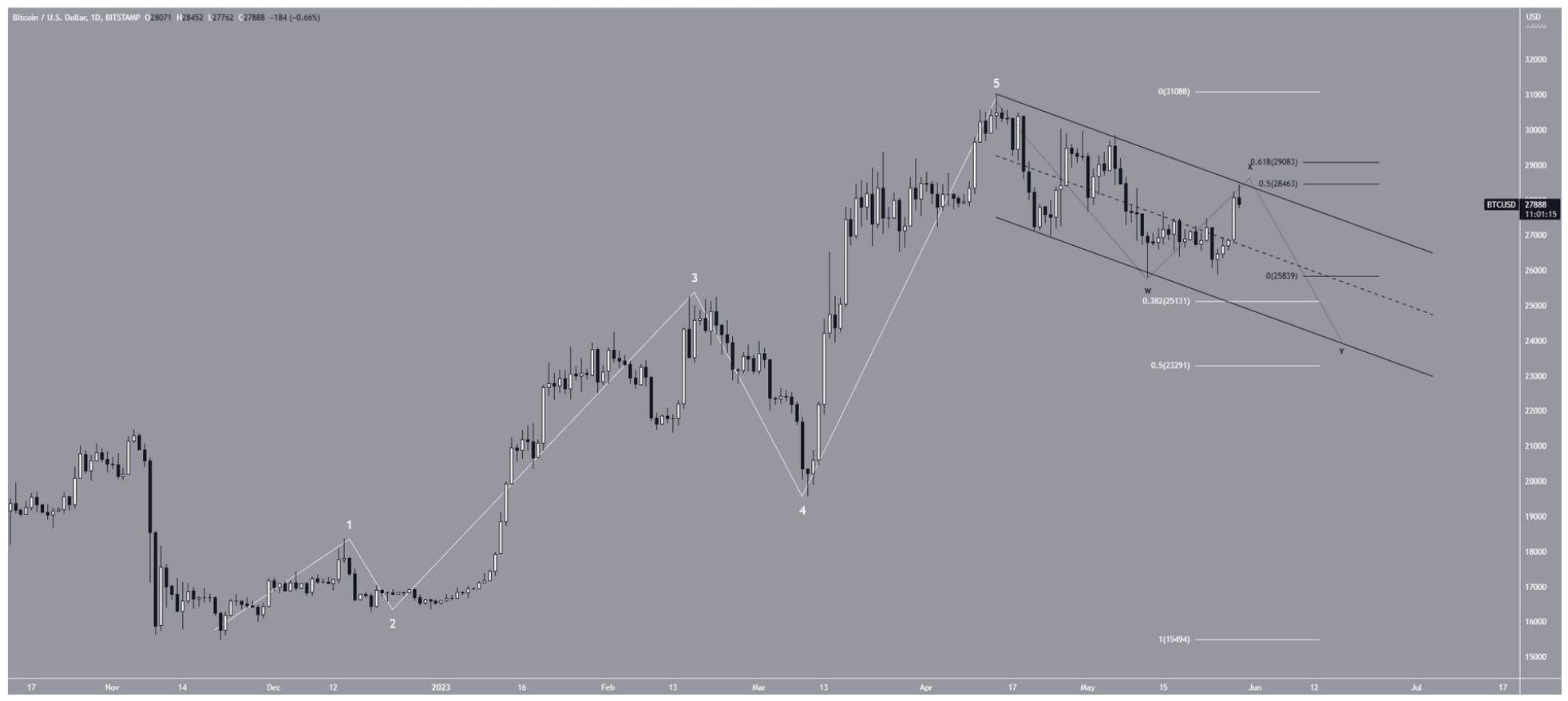

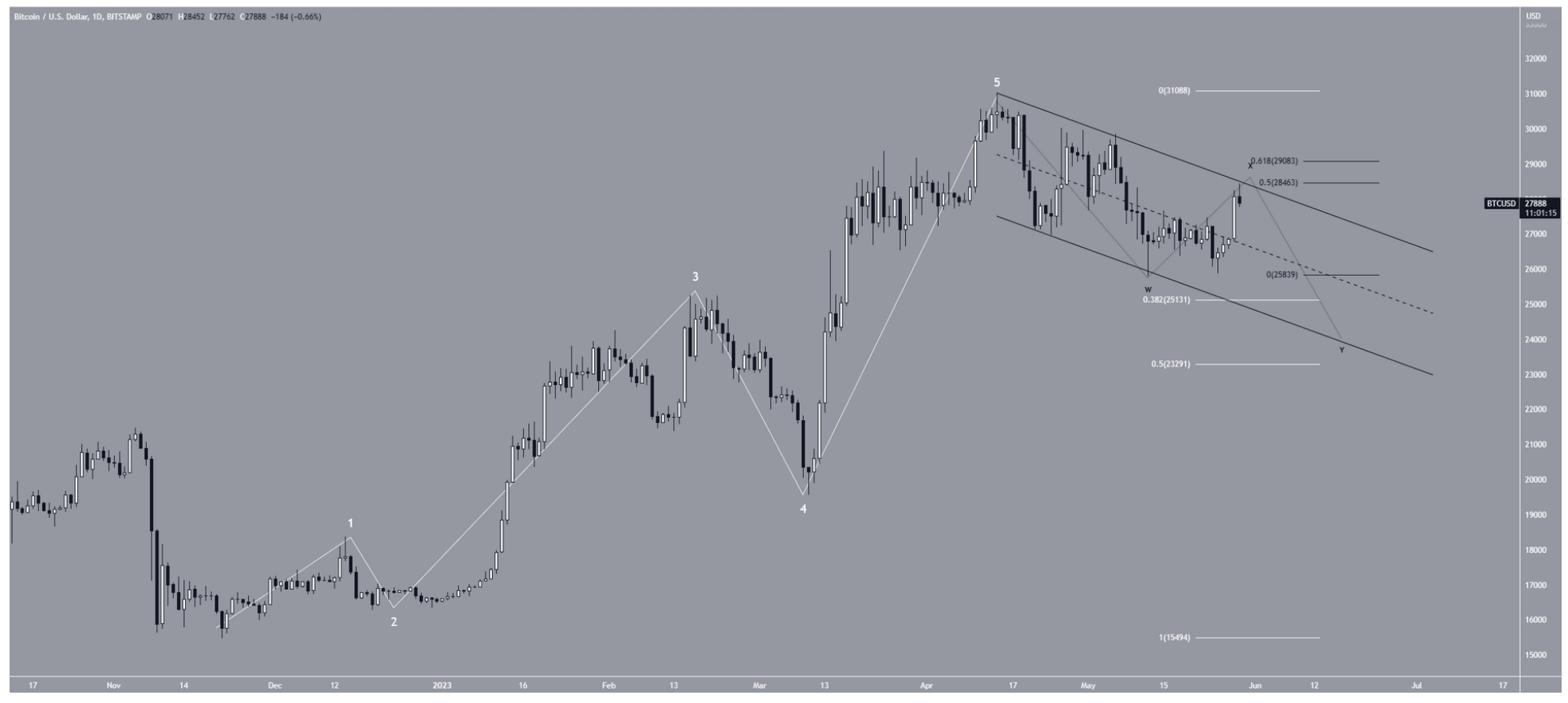

Technical analysis within the daily timeframe reveals that since April 14, BTC‘s price has been trading in a decreasing parallel channel. This formation is typically considered a bullish pattern. Consequently, the most likely scenario is a break from this channel. On May 12 and 25, the BTC price seemed to have broken below the $26,800 support level and the middle of the channel. However, it rebounded on both occasions.

Will Cryptocurrencies Rise?

The Elliott Wave Theory and Fibonacci levels suggest an eventual exit from this channel. Yet, there could be another dip before this final break. The current downturn appears to be the technical explanation. The primary count indicates that the price completed a five-wave up move, which began in November 2022. Following this, the decline since April 16, 2023, is part of a corrective W-X-Y structure.

According to this, the price seems to have started the Y wave. If the current X wave fails to reach its target of $31,000, we might see Bitcoin dip towards $23,000. However, there is an important caveat. If Bitcoin closes above $29,000, the last corrective wave could end prematurely. In this scenario, Bitcoin could rise as high as $35,000.

But, data set to be released throughout the week could potentially disrupt these bullish expectations. However, considering the most positive perspective, Hong Kong’s move on June 1, followed by the release of cryptocurrency-favorable data, could strengthen the currently weak prospect of a price increase.