Jurrien Timmer, the Global Macro Director of Fidelity Investments, one of the world’s largest asset management companies, drew a striking parallel between the volatile rise and fall cycles of cryptocurrencies and the technology bubble. In this context, he made an intriguing analogy for Bitcoin (BTC), the largest cryptocurrency.

“Bitcoin is the Apple of the Cryptocurrency Era”

Timmer, noting that some tech stocks such as Amazon and Apple emerged as winners from the bursting tech bubble, stated that the cryptocurrency industry is also under a similar condition, where some cryptocurrencies may thrive while others may die. According to Timmer, Bitcoin could be the “Apple of the cryptocurrency market“.

The explosion cycle of the cryptocurrency market can be compared to the dot-com bubble of the late 1990s. The inflating internet bubble raised many unqualified stocks to astronomical levels, but when the bubble burst, these stocks lost most or all of their value. Companies like Apple and Amazon stood apart from those who lost long-term gains during this process. The same situation has been proven valid for the cryptocurrency market so far. Assuming Bitcoin to be the “Apple of the cryptocurrency era”, it might make sense for the biggest cryptocurrency not only to survive the harsh crypto winter but also to develop and gain market share from other cryptocurrencies. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Big Crash Warning For Bitcoin

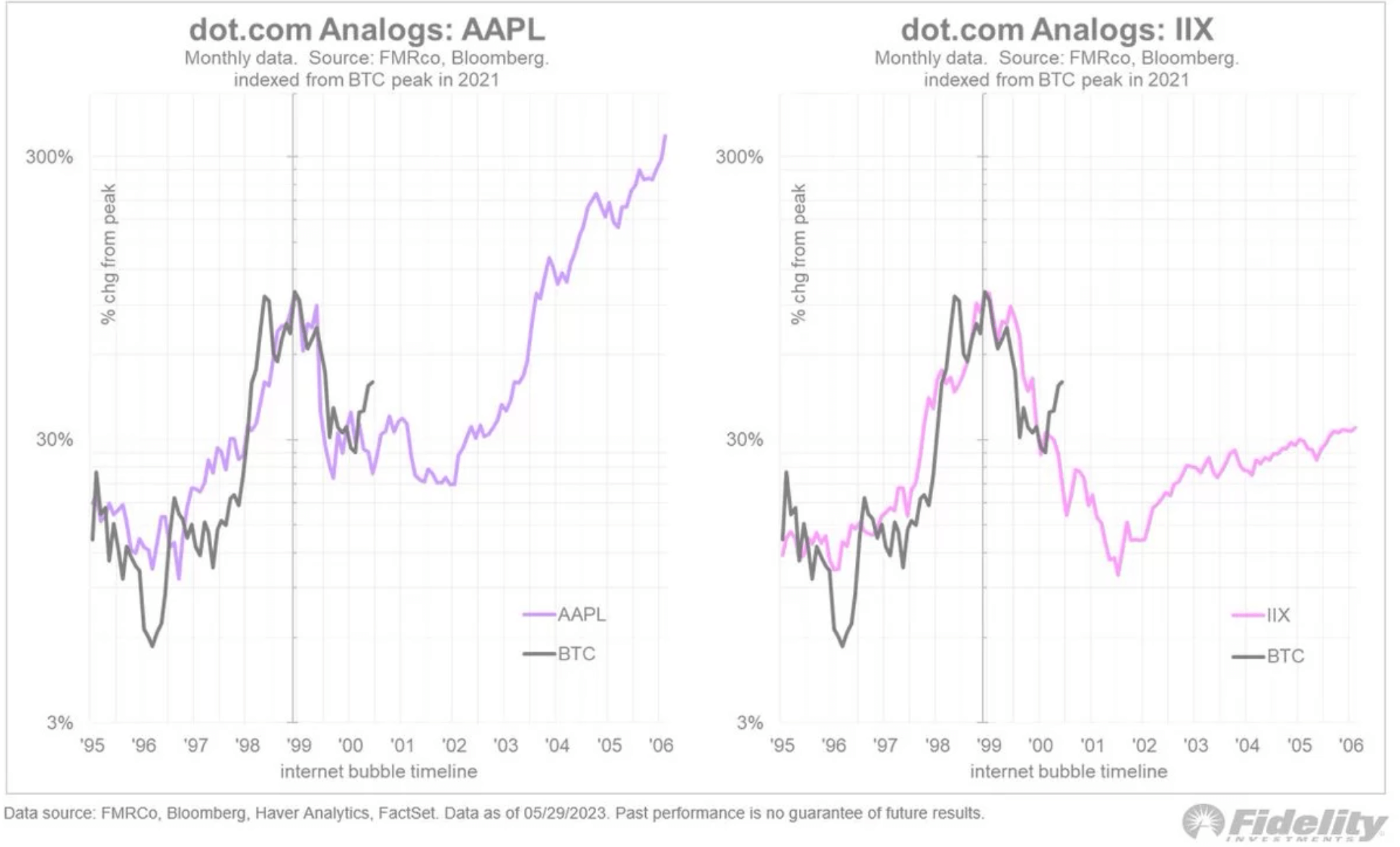

Overlaying the current price graph of Bitcoin onto those of Apple and an internet stock index from twenty years ago, Timmer claimed that BTC seems to be demonstrating a similar price action:

Below, I have shown Bitcoin today overlaid with Apple from twenty years ago (on the left) and Bitcoin overlaid with the Interactive Internet Index (IIX) on the right. The IIX is an internet stocks index that started from zero value and returned to zero, and is now discontinued.

Timmer, also gave a stern warning about a significant crash for Bitcoin:

Even robust companies like Apple experienced a major decline when the bubble burst, but they recovered to become a dominant force, while many companies faded into obscurity. Only time will tell what awaits Bitcoin.

If Bitcoin continues to follow Apple’s path, it implies that the price of the largest cryptocurrency could one day rise over 80 percent.

Türkçe

Türkçe Español

Español