The price of Bitcoin continues to hover around $25,715, stuck in a boring sideways movement. The previous sideways trend lasted for 10 days, and now it’s happening again. Investor confidence in the upward trend has weakened, and volumes are at historic lows since May. If this month continues like this, we will see the lowest volume in a quarter since 2019.

What Will Happen to Bitcoin?

At the time of writing, the price seemed to be intending to test the $25,300 support level. The short-term outlook is negative as volumes continue to decline. Investors are reducing their risk due to concerns that the Fed will continue its tight monetary policy. Moreover, the absence of an announcement of a ceiling interest rate puts a damper on the expectation of a 2024 halving bull run.

US markets closed in the negative, and the fight against inflation could become even more challenging due to the increase in oil prices. Despite many positive news, the negative macro outlook is causing cryptocurrency investors to stay on the sidelines and watch what’s happening. The possibility of deeper dips in altcoins will depend on how BTC performs at $25,300.

Expert Crypto Analyst’s Prediction

After reaching $27,000, the crypto king lost $26,000 again. However, an analyst known as CryptoCon says there are signs of a trend reversal. Typically, when Bitcoin crosses the 50 mark on the weekly Relative Strength Index (RSI), it enters a bull market. Historically, bull markets follow when the weekly RSI recovers from two support levels.

BTC’s weekly RSI value is around 43, close to the first support level. Therefore, if it manages to rebound, we can expect a strong price increase. The MACD continues its downward trend, indicating that the RSI could go towards the second support level.

While there is a possibility of price fluctuations for BTC, other data sets indicate that the accumulation period will soon come to an end. According to the November 28 cycle theory, Bitcoin’s accumulation phase will end within a few months. This also coincides with the upcoming halving period of Bitcoin, which could serve as a trigger for BTC to reach its all-time high.

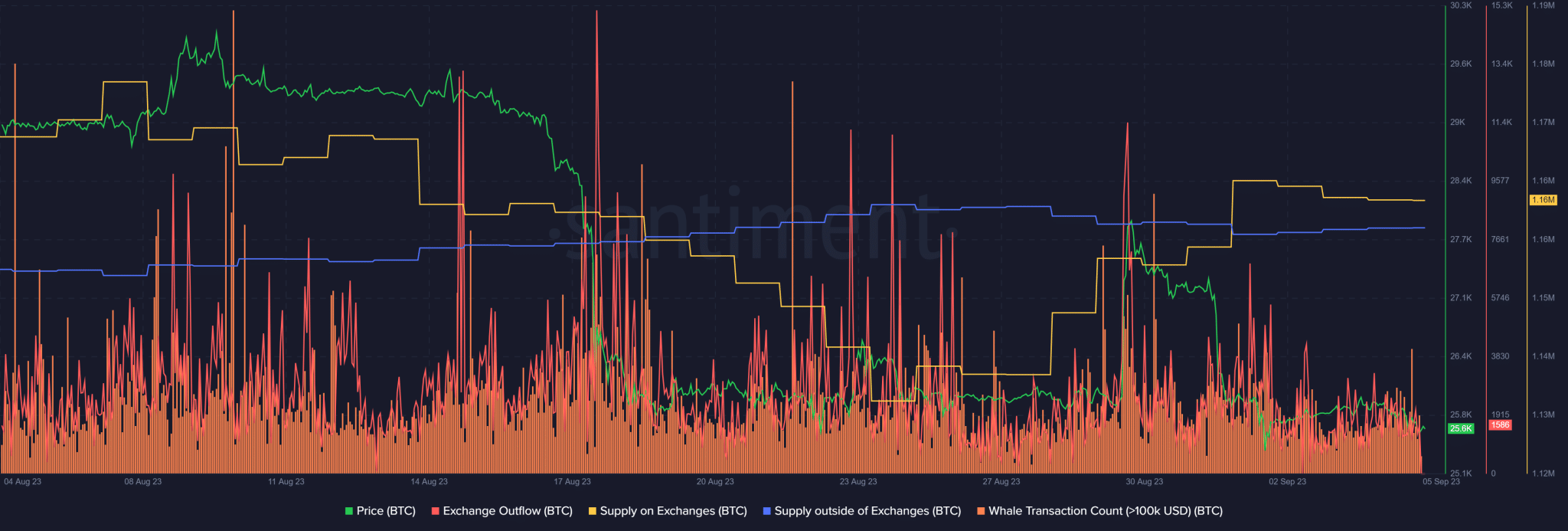

Looking at Santiment’s chart, it can be seen that investors are accumulating when BTC’s price is slow-moving. Whenever BTC’s price drops, there is an increase in exchange outflows, meaning investors are buying BTC.

Türkçe

Türkçe Español

Español