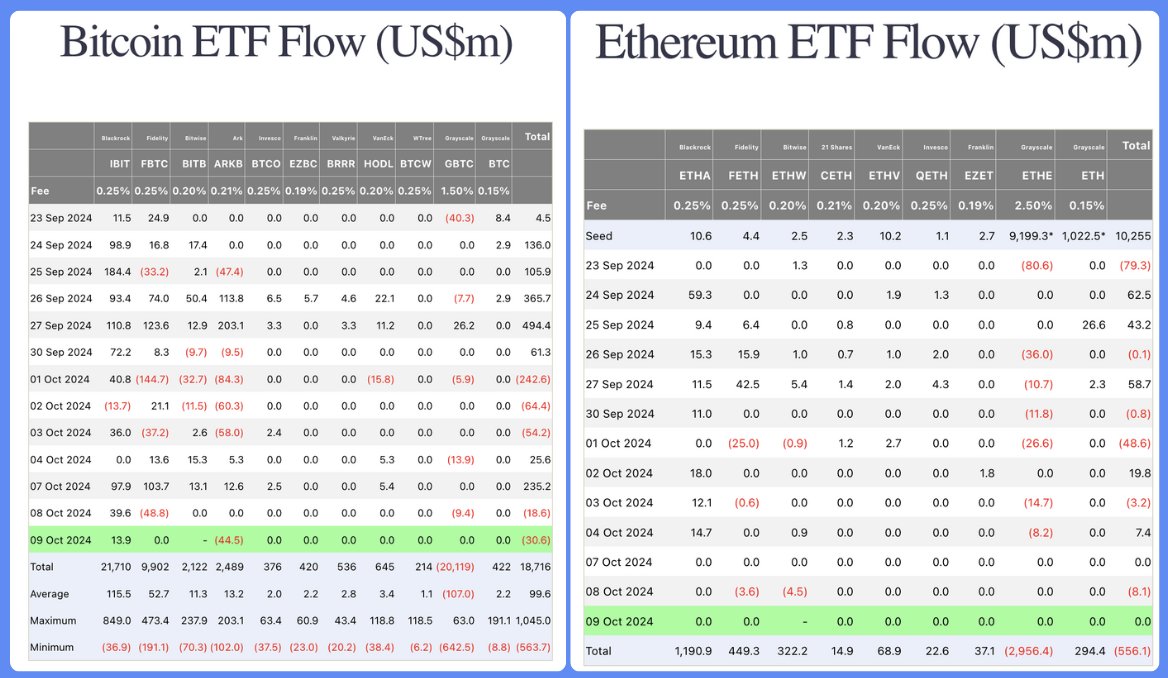

As Bitcoin’s price retreats from the critical $60,000 mark, the spot Bitcoin  $118,208 ETF market has witnessed a slight increase in net outflows. On October 9, the total net outflow across ten spot Bitcoin ETFs reached 105 BTC, amounting to approximately $6.5 million. Notably, Fidelity’s FBTC ETF experienced a considerable outflow of 787 BTC, valued at about $48.55 million. Meanwhile, spot Ethereum

$118,208 ETF market has witnessed a slight increase in net outflows. On October 9, the total net outflow across ten spot Bitcoin ETFs reached 105 BTC, amounting to approximately $6.5 million. Notably, Fidelity’s FBTC ETF experienced a considerable outflow of 787 BTC, valued at about $48.55 million. Meanwhile, spot Ethereum  $2,975 ETFs also encountered significant withdrawals, totaling 3,442 ETH, equivalent to roughly $8.32 million. The highest outflow in this sector was observed in the Bitwise Ethereum ETF, which lost 1,865 ETH, valued at approximately $4.53 million.

$2,975 ETFs also encountered significant withdrawals, totaling 3,442 ETH, equivalent to roughly $8.32 million. The highest outflow in this sector was observed in the Bitwise Ethereum ETF, which lost 1,865 ETH, valued at approximately $4.53 million.

Spot Bitcoin ETFs Draw Attention with Net Outflows

As Bitcoin’s price declines, activity in the ETF market has intensified. Recent data reveals that the FBTC, led by Fidelity, saw a notable amount of outflows. Currently, Fidelity’s total assets amount to 178,778 BTC, valued at nearly $11 billion.

These outflows are likely linked to investors taking short-term profits or seeking to reduce risk in response to volatility in the leading cryptocurrency‘s price.

Similar Trends in Spot Ethereum ETFs

A similar scenario is evident in the Ethereum sector. On October 9, spot Ethereum ETFs recorded a net outflow of 3,442 ETH, adding up to a total value of $8.32 million.

The Bitwise Ethereum ETF led the way with the largest outflow, shedding 1,865 ETH, valued at approximately $4.53 million. The rise in ETF outflows, paralleling Ethereum’s overall market trends, indicates that investors are adopting a more cautious approach amid market uncertainties.

These recent net outflows demonstrate an increasing sensitivity among investors to the rising volatility in the cryptocurrency market, prompting them to reassess their positions. Developments in spot Bitcoin and Ethereum ETFs continue to serve as significant signals for market participants.

Türkçe

Türkçe Español

Español