Rarely does the local cryptocurrency of a forked network perform better than the original, but Bitcoin Cash (BCH) investors have been over the moon about its performance since mid-June.

Bitcoin Cash Soars

From a broader perspective, BCH saw a 115% rally in the last seven days, reaching $234. The cryptocurrency rose by a whopping 154% from its one-month low.

At the time of writing, the cryptocurrency was trading at levels seen in May 2022. BCH’s parabolic movement has pushed it into the overbought zone. Especially after the strong rally achieved in the last two weeks, a significant sell-off wave could be expected for Bitcoin Cash. However, understanding the reasons behind the current rally can give an idea of what to expect.

Bitcoin Cash Analysis

No official announcements have been made so far that would trigger such a major rally. Nonetheless, we occasionally see an unexpected surge in a cryptocurrency. This could be due to whales rallying behind a crypto that they can push upward, thus attracting the individual investor segment.

The only development supporting the price by EDX Markets, and perhaps the possibility of it being classified as a commodity while the SEC is targeting altcoins, could be cited as a reason for the rise. On the technical front, short liquidations could also be driving up prices. Looking at the long and short liquidations of BCH, short liquidations have been more dominant in the last few days. The increase in long positions during the same period indicates intense optimism in the upward direction.

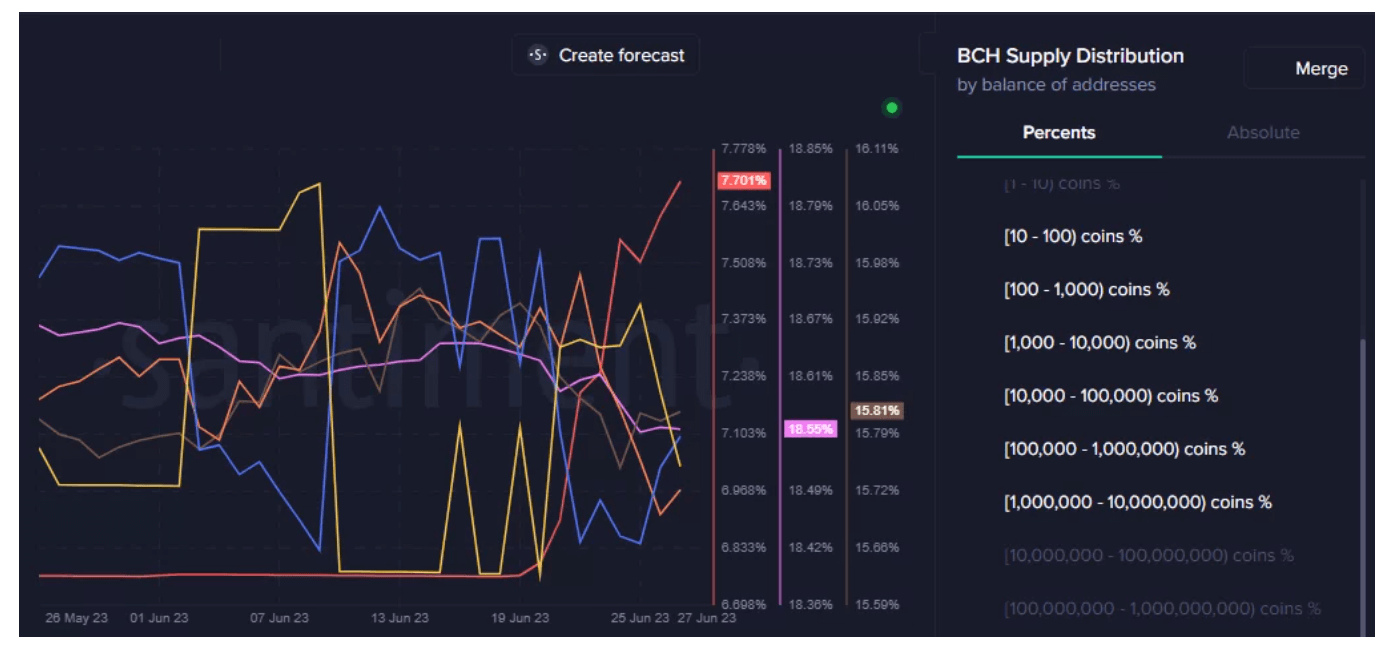

The supply distribution metric reveals a difference of opinion among whales. For instance, the largest whale category (holding more than 1 million BCH) has been buying for the last two weeks. This has encouraged many upper whale categories to do the same in the last three days.

The supply distribution metric confirms that whales are actively participating in the Bitcoin Cash rally. Investors should also not forget that significant profits have been made during this process. In particular, some whales in the range of 100,000 to 1 million have been selling for a while now.

Bitcoin Cash’s price could disappoint those planning to short at the peak, and the possibility of an upward pin above the dollar should not be overlooked. If we see price closes below $175, we might see a real decline starting towards $155 and $110. However, the current level continues to be risky.