Bitcoin’s (BTC) price has surged to a historic high of $80,000, supported by increased interest from individual and institutional participants, resulting in high trading volume. However, market experts are divided on the future trajectory of Bitcoin’s price, as it enters a price discovery phase. While some predict that the upward trend will continue, others warn of a potential correction.

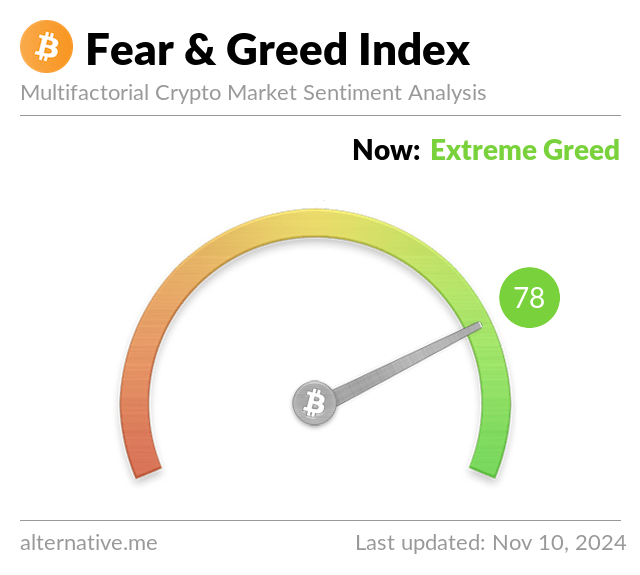

Extremely Greedy Signal: Possible Profit-Taking Ahead

The Crypto Fear and Greed Index currently stands at 78, indicating a signal of “Extreme Greed.” This high reading suggests rising optimism and excitement among market participants, potentially driving prices even higher in the short term. However, periods of extreme greed are often precursors to corrections, prompting investors to consider profit-taking to secure their gains.

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Ki Young Ju, CEO of CryptoQuant, emphasized that all Bitcoin  $118,551 wallet addresses are currently in profit, suggesting that some investors might consider capitalizing on this opportunity by selling. Ju noted the price discovery phase Bitcoin is experiencing, stating, “We often see corrections at these levels.”

$118,551 wallet addresses are currently in profit, suggesting that some investors might consider capitalizing on this opportunity by selling. Ju noted the price discovery phase Bitcoin is experiencing, stating, “We often see corrections at these levels.”

Given the history of significant profit-taking by large investors at previous peak prices, a similar “fourth wave correction” could be expected at this new $80,000 peak.

Investors Should Exercise Caution

Although reaching a new peak is seen as a pivotal moment in the market, experts emphasize the importance of a cautious approach. Sharp price movements at historical high levels can trigger sudden declines, so investors with lower risk tolerance are advised to proceed carefully.

Whether the rally in the largest cryptocurrency will continue depends on how resolute investors are at this juncture and the overall risk appetite in the market.

Türkçe

Türkçe Español

Español