Senior Macro Strategist at Bloomberg Intelligence, Mike McGlone, closely monitors the movements of cryptocurrencies. In his recent market forecasts, he had hinted at a drop in Bitcoin’s price. Although the plunge wasn’t as drastic as expected, we’ve seen Bitcoin being pushed to the levels of $25,000, partly due to the SEC’s influence. But which altcoin is he optimistic about?

Bloomberg Analyst on Ethereum

In his latest market evaluation, McGlone speaks of rising demand and diminishing supply for Ethereum (ETH), marking these as indicators of an upward trend for the smart contract platform. However, the strategist points out that ongoing Federal Reserve interest rate hikes and weakening technicals for financial markets could limit the price movement of ETH.

Demand and adoption seem to be increasing against a decreasing supply for Ethereum (ETH), which looks positive for its price. However, a negative Fed and technical ground in early June could limit the prices.

During the bull season, the aspect Bloomberg’s analyst emphasizes could initiate an unprecedented bull run for ETH.

ETH Future Expert Commentary

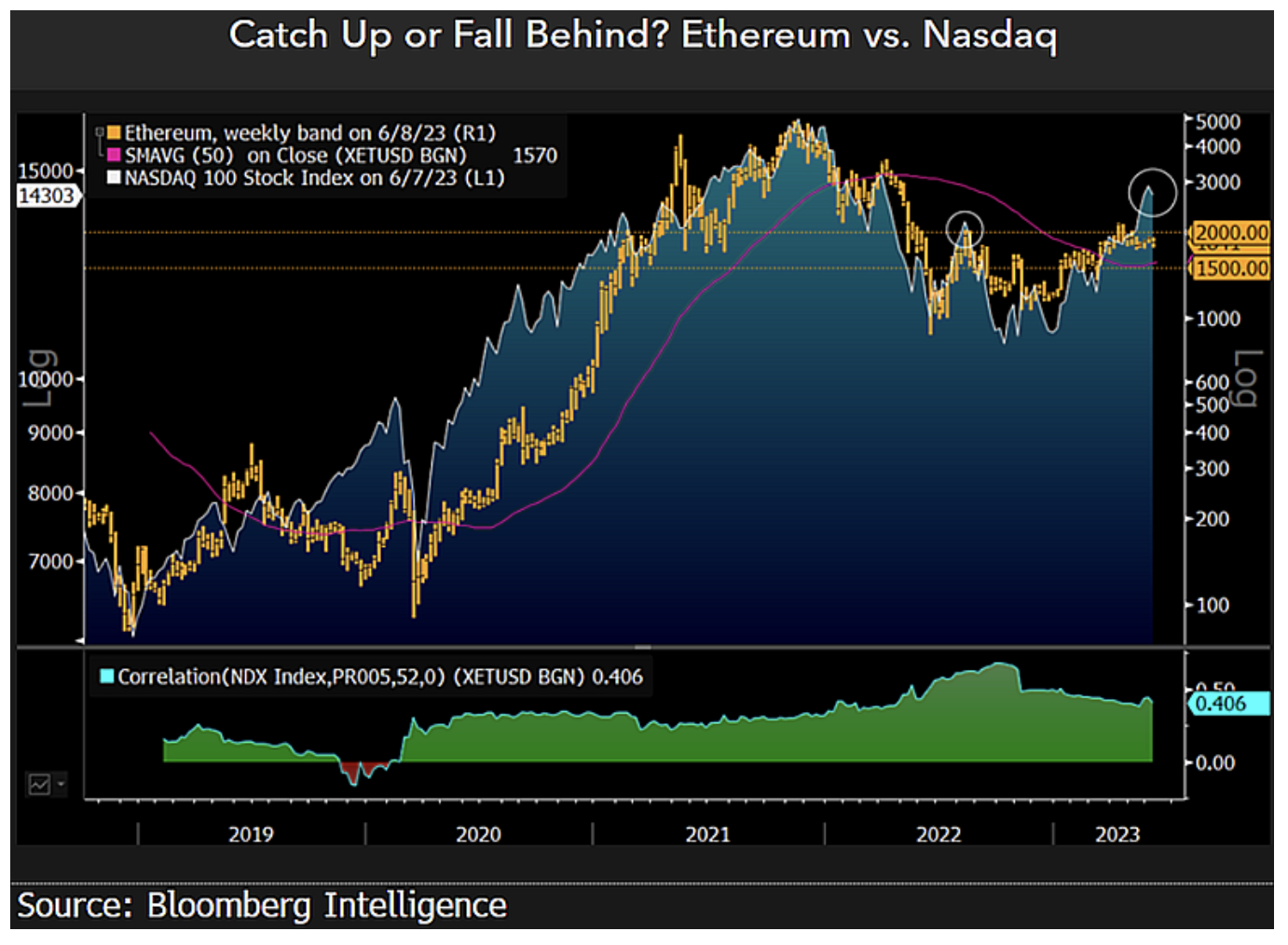

McGlone’s chart looks at economic indicators, such as copper futures and federal fund futures, suggesting a possible economic slowdown. He also compares Ethereum’s performance against the Nasdaq 100 Stock Index, noting that ETH struggles to exceed $2,000 despite the Nasdaq’s recent rally.

Different Weakness and Ethereum’s $2,000 Ceiling – Despite reaching its 52-week high in the Nasdaq 100 Stock Index in the second quarter, Ethereum’s inability to stay above $2,000 may indicate a resistance ceiling for the crypto.

He notes that Bitcoin (BTC) is also experiencing a downturn against the rising Nasdaq, mainly due to the potential of artificial intelligence (AI).

Bitcoin is minimally backing the approximately 10% jump in the Nasdaq 100 Stock Index, where Nvidia ranks fourth. Bitcoin’s decline while the Nasdaq is rising is a rare occurrence.

The negativity in Bitcoin’s price stems largely from decreasing volumes. A volume drop below $30 billion indicates a significant decline in interest. During the last bull season, only DOGE‘s volume record hit $40 billion. The cumulative volume of cryptocurrencies barely reached half of this amount several times in May.