A small DeFi protocol, BarnBridge (BOND), has become the latest victim of the U.S. Securities and Exchange Commission (SEC), which has been targeting the cryptocurrency market with its ongoing investigations. While details of the investigation have not been disclosed yet, it is expected that the DeFi protocol will preemptively close its liquidity pools.

Investigation Announced by BarnBridge DAO’s Lawyer

The SEC, which made a significant impact in June with lawsuits against Binance, Binance CEO CZ, and Coinbase, has now launched an investigation into DeFi protocol BarnBridge. Last week, newly appointed lawyer Douglas Park of BarnBridge DAO, which operates the protocol, recommended suspending all products linked to BarnBridge. Although the details of the investigation have not yet been disclosed, Park reported that the SEC is investigating BarnBridge and individuals associated with the protocol.

To minimize potential legal liability, Park suggested, “Existing liquidity pools should be closed, and no new liquidity pool should be opened. All work on BarnBridge-related products should be halted, and no payments should be made for any work related to BarnBridge until the next announcement.”

Tyler Ward, co-founder of BarnBridge, confirmed Park’s message shared on DAO’s Discord channel, stating, “I have been advised not to comment on this matter moving forward. It would have been the worst rug pull attempt ever if we had made this up.”

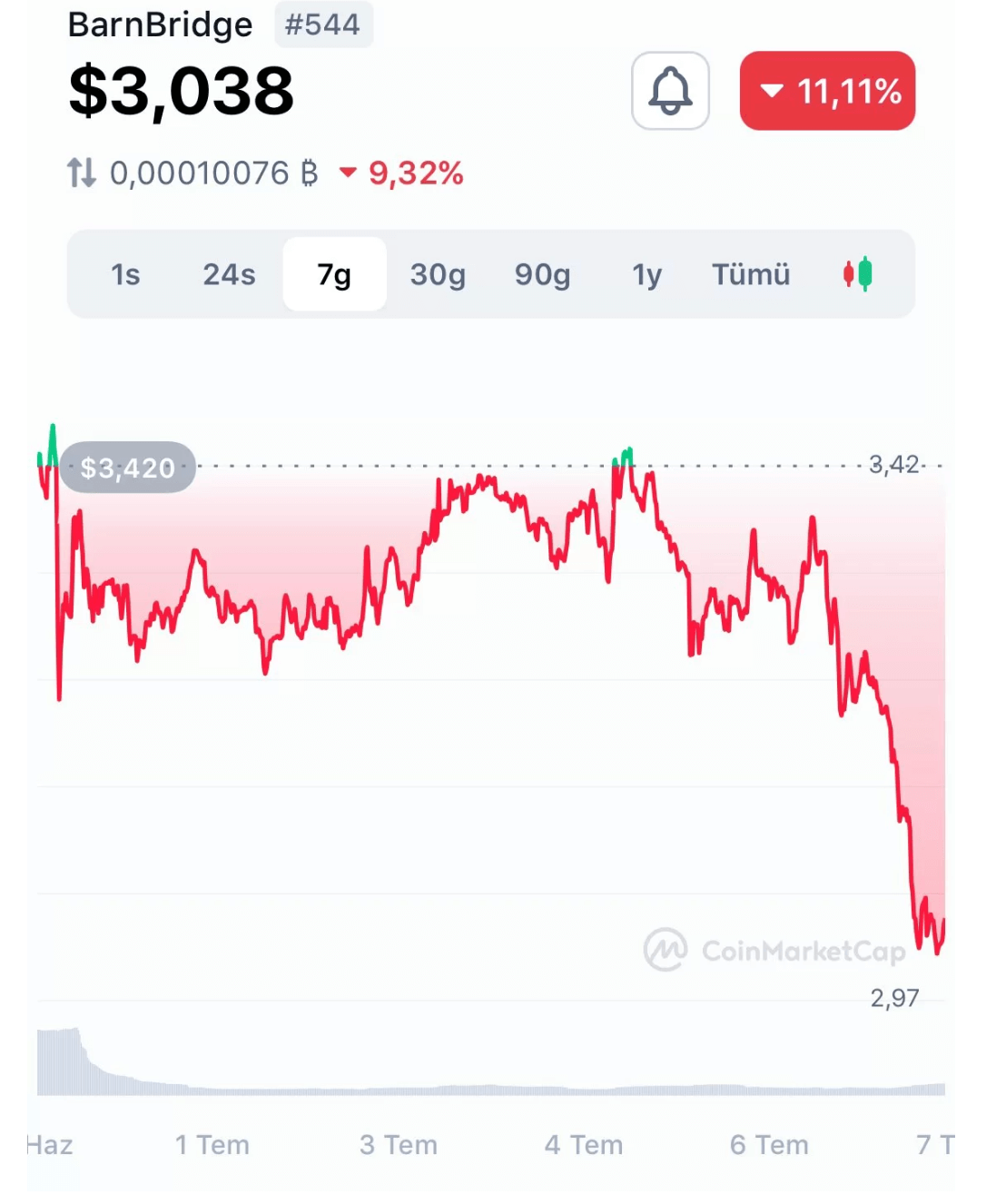

BOND, Protocol’s Native Asset, Plummeted Rapidly

According to data from the crypto data platform CoinMarketCap, BOND, the native asset of BarnBridge protocol, sharply fell after the investigation news. BOND, which has declined more than 11% in the last 24 hours, has receded to $3.

Data from the DeFi data platform DeFi Llama reveals that the total value locked (TVL) in BarnBridge is currently only at $1.35 million, compared to its peak level of approximately $574.9 million recorded in November 2020.

Launched in September 2020, the DeFi protocol aimed to help investors hedge against price volatility. BarnBridge was offering an interest rate swap that allowed any variable return to be converted into a fixed rate for this purpose.

The investigation opened by the SEC into BarnBridge is a new example of the U.S. regulatory body’s hard stance targeting the crypto market, indicating that it may now be targeting the DeFi market as well.