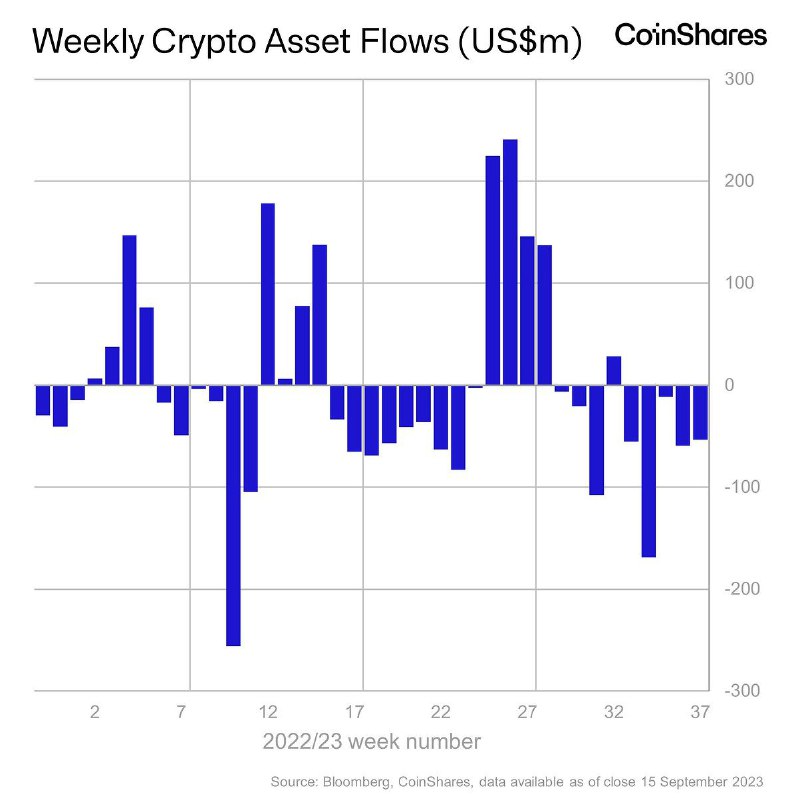

Crypto investors closely monitor the changing attitudes of institutions towards the markets. How do they do this? Of course, we see it in the weekly reports of institutional funds. As the sentiment of bullishness increases in the markets, institutions show more interest in crypto stocks and ETPs. However, there have been massive outflows from crypto funds for weeks now.

Institutional Crypto Report

The latest report published by CoinShares sheds light on the current state of the crypto market and the approach of institutional investors. Last week, a total of $54 million was withdrawn from crypto investment products. In 8 out of the past 9 weeks, there was a total outflow of $455 million. Bitcoin represented 85% of the total outflows last week with a $45 million withdrawal. As institutions flee from BTC funds, they also started to withdraw from short BTC funds. This indicates that they do not have a clear expectation in either direction but are taking cautious measures to protect themselves from a decline.

Solana, Cardano, and XRP may have seen weak inflows of less than $1 million, but institutional interest in altcoins is promising. On the other hand, blockchain stocks experienced an outflow of $9.6 million last week. The outflows from blockchain stocks have been continuing for 6 consecutive weeks.

Türkçe

Türkçe Español

Español