The key news for June was the Fed’s interest rate decision, which came as expected. So, what’s next for Bitcoin? The price, under additional pressure due to the SEC, remained in place as US stock markets rose. The Fed’s decision has not yet stirred the price as expected. So, what will happen next?

Bitcoin (BTC)

There is still a glimmer of hope for the bulls as the price is holding above the $25,000 support. Michael Saylor, co-founder of MicroStrategy, suggested in an interview with Bloomberg on June 13 that the regulatory pressure from the Securities and Exchange Commission could lead to a rise for Bitcoin. He also made some extravagant predictions. Given that he has tied a significant part of his fortune to Bitcoin, his extreme optimism seems understandable.

Investors despise uncertainty and typically stay on the sidelines until clarity emerges. The same could occur in the crypto markets in the short term. A trend movement is likely to start only after investors sense some regulatory clarity. Currently, declining volumes and volatility indicate that investors are staying on the sidelines. We might not see larger movements for a while.

Bitcoin Price Comment Chart

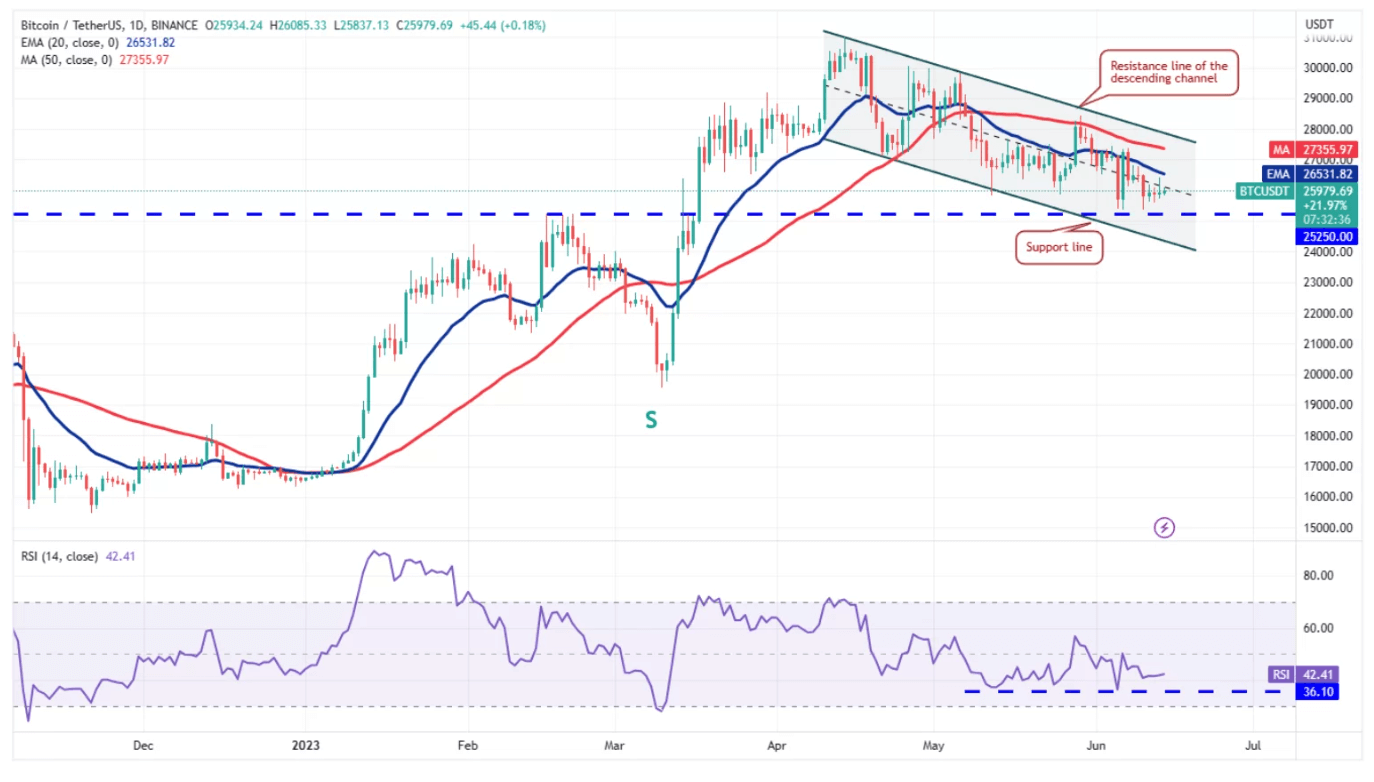

On June 13, Bitcoin approached its 20-day exponential moving average (EMA) of $26,531 but couldn’t surpass this level. This reluctance among investors is allowing bears to maintain dominance. The price has been wedged between the 20-day EMA and the $25,250 support area for the past few days. Even the Fed decision couldn’t change this yet.

Downward sloping moving averages suggest bear dominance, but the positive divergence in the relative strength index (RSI) could indicate decreasing selling pressure.

If buyers can push the price above the 20-day EMA, the BTC/USDT pair could rise to the resistance line of the decreasing channel. Buyers need to close above this region to start a journey to $31,000.

On the other hand, if the price falls from the current level and drops below $25,250, targets of $23,600 and $20,000 may come into play. As this article was written, the king cryptocurrency found a buyer at $25,890. The expectation of a rate hike in July has already dampened risk appetite. Additionally, the Fed stated that it would be making two more rate increases, thus keeping the risk appetite at bay.